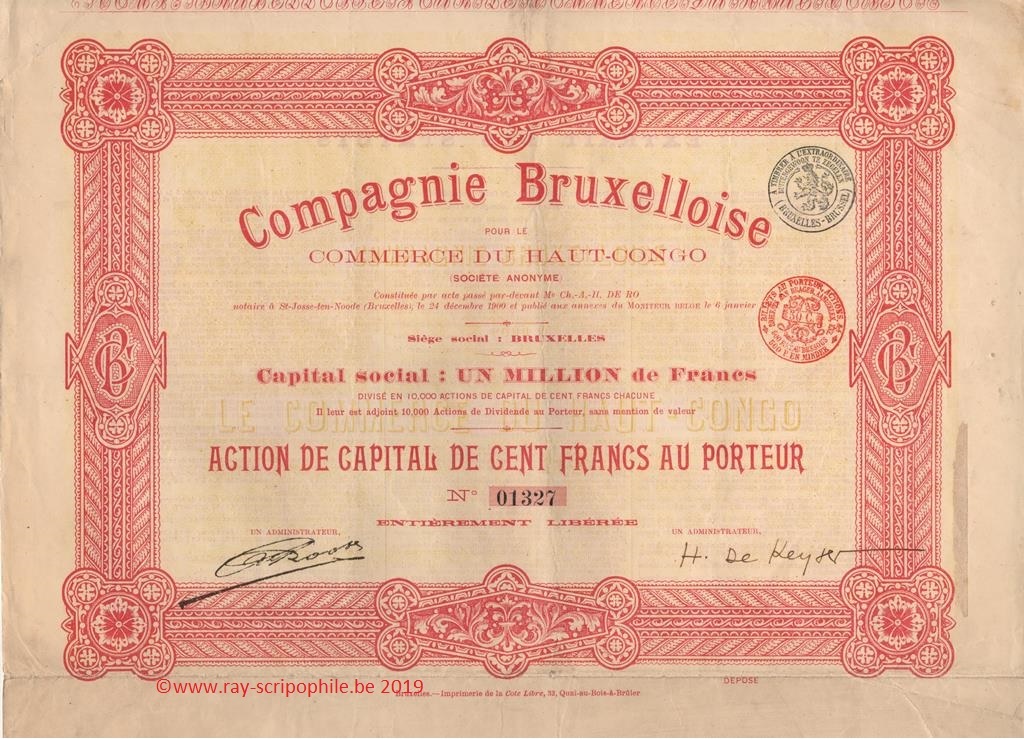

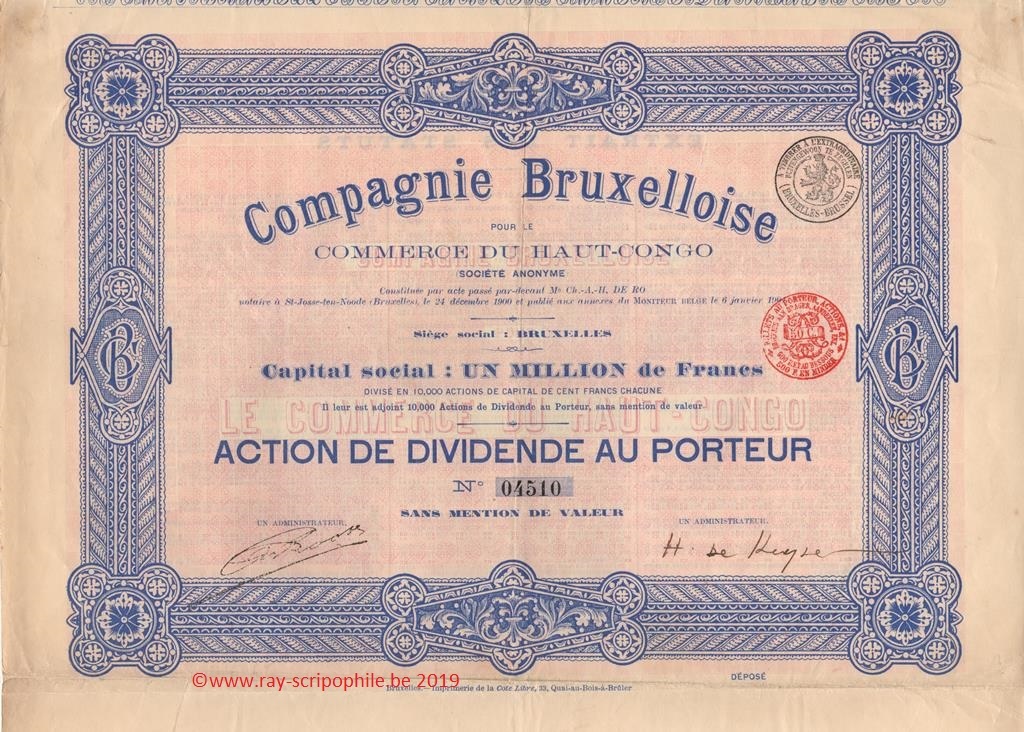

Compagnie Bruxelloise pour le Commerce du Haut-Congo S.A.

Constitution

This company was founded on 31 December 1900 on the initiative of the companies Nieuwe Afrikaansche Handelsvennootschap, L'Africaine Banque d'Etudes et d'Entreprises Coloniales, Le Trust Colonial and various personalities such as Messrs. Alfred and Arthur Roose. The capital of one million francs was represented by 10,000 shares with a capital of 100 francs; in addition, 10,000 dividend shares without nominal value were created. The registered office was established in Brussels.

Of the 10,000 capital shares, 7,500 were allocated to the contributor; the remaining 25% were subscribed and paid up by:

L'Africaine Banque d'Etudes et Entreprises Coloniales, 1,000 shares; Le Trust Colonial, 1,000 shares; Messrs. Arthur Boll, 100 shares; Alfred Roose, 100 shares; Arthur Roose, 100 shares; Henri De Keyser, 100 shares; Camille d'Heygere, 50 shares; Albert Vanderstichelen, 50 shares.

The contributor also received 7,500 dividend shares; the remaining 2,500 shares were distributed among the various comparators in accordance with their agreements.

Contribution(s)

The Nieuwe Afrikaansche Handelsvennoostschap contributed four properties with all the buildings erected there, located in:

- Upoto Umangi, on the right bank of the Congo.

- Irengi, on the left bank of the Congo.

- Lulonga, at the confluence of the Lulonga and Congo rivers.

- Muenekundi, on the right bank of the Kwango.

Object

Trade and cultivation of rubber and other soil products in Congo.

This object was partly realized by the direct or indirect exploitation of the properties brought by the "Nieuwe Afrikaansche Handelsvennootschap" described above.

To be able also to develop, either directly or by way of contribution, financial intervention or by any other means, other enterprises, whatever their nationality and whatever their nature, whether their purpose is trade, industry, exploitation of the riches of the soil or subsoil, public works, communication or transport routes by land and water.

To this end, it may set up establishments for their direct operation, set up trade unions or companies, transfer, lease back, transfer the companies it has acquired, contribute them to companies already formed or to be formed, intervene in the development of such companies or resort to any other procedure likely to achieve and extend the application of its corporate purpose.

To be able to buy, sell and discount any securities of the State, companies, associations or public and private companies, and to carry out all banking, credit or treasury operations on these securities, or with those who issue or discount them.

To be able to extend its operations to any country and may handle them in the name of third parties, either on its own behalf or on behalf of or in participation with third parties, as well as in its own name.

To be able to merge with other companies (12-(06/01/1901)-82).

Changes in capital, event(s), shareholding(s), dividend(s), listing, etc.

On April 10, 1901, 5,000 shares were presented for public subscription at 112.50 francs.

The Irengi post was sold to the Société Forestière et Commerciale du Haut-Congo against 30% of the harvest of all products with a minimum of 18 tons of rubber per year. The Upoto-Umangi post was perfectly situated for the trade and in an area where rubber was abundant, near the Abir and Antwerp concessions. The Lulonga and Muenekundi posts promised good results (21-(1902 T1)-725/726).

In 1905, the Kwango posts were transferred to the Comptoir Commercial Congolais in return for a 10% share in the profits. In 1906, this participation brought in 23,800.85 francs; in 1907 and 1908 it was nil; in 1910 it was 87,811.39 francs. In 1912, this participation was exchanged for 4,400 fifths of Comptoir Commercial Congolais shares. In 1913, the Company made 1,000 of these shares for 55,000 francs.

In 1906, the establishments of Haut-Congo were sold to the Syndicat de l'Umangi (dissolved in 1909) (21-(1938-T2)-1305).

On June 30, 1909, at the EGM, and following the arrangement with the Nieuwe Afrikaansche Handelsvennootschap company, the latter paid back to the present company 2,000 shares with a capital of 100 francs that had been allocated to it when the Compagnie Bruxelloise pour le Commerce du Haut-Congo was set up; these 2,000 shares were purely cancelled and reduced the capital by 200,000 francs.

In order to bring the real value of the remaining capital into line with the nominal value of the 8,000 capital shares, the same meeting decided to reduce the capital to 400,000 francs; the nominal value of the capital shares was reduced to 50 francs.

Finally, following talks with the company's creditors, 1,000 preference shares of 100 francs each with a fixed interest rate of 4% were created. These shares were offered for subscription to the creditors, who undertook to subscribe for the amount of their claims. The capital of 500,000 was then represented by 1,000 preference shares of 100 francs and 8,000 shares with a capital of 50 francs. In addition, there were also 10,000 dividend shares (12-(21/07/1909)-4527).

In 1918, the 4,400 fifths of Comptoir Commercial shares were issued between 45 and 50 francs each. The Company acquired 150 Sennah Rubber shares as a cash investment; these shares were sold in 1919.

The activity of the Company was limited to the management of its portfolio which included, at the end of 1919, 5,000 ordinary shares of Société d'Entreprises Coloniales and 1,000 shares of capital Société Franco-Malgache which were remitted to it by the Colonial Trust in payment of its debt of 84,527 francs.

In 1920, the Company bought 26 ordinary shares Belgika at 1,350 francs, 288 shares Intertropical Comfina at an average rate of 183 francs and subscribed for 100,000 francs nominal value to the Belgian 5% loan. These shares were sold; the Company only owned shares Charbonnages de Monceau-Fontaine.

On the other hand, the Company had not resumed any personal activity in Africa (21-(1938 T2)-1305).

The EGM of February 5, 1935 noted that at the close of the 1933 financial year the deficit balance was more than half of the capital and decided to continue the company's activity (12-(27/02/1935)-1732).

Stock market prices :

Fiscal years 1901 1902 1903 1904 1905 1906 1907 1908

Capital share price at 31 /12 100 35 19 28 51 40 24 higher rated

Dividend share price at 31/12 45 35 5 12 25 21 20 higher rated

(21-(1910 T1)-38).

The company only distributed dividends for the fiscal years 1909 and 1910, i.e. 4 francs for preferred shares and 5 francs for capital shares (21-(1938 T2)-1306).

Dissolution and liquidation

On June 8, 1938, the EGM decided to dissolve the company and put it into liquidation.

The preferred shares were redeemed at a price of 100 francs (21-(1938 T2)-1306).

A first distribution of 62 francs was distributed to the capital shares (stamp on the security), since December 1, 1940 (21-(1940 T1)-1001).