COMPAGNIE COLONIALE BELGE ALIAS PLANTATIONS ET ELEVAGES DE KITOBOLA - S.A.

Constitution

Have appeared:

- The Société anonyme « La Coloniale belge », Etablissements Buzon, , représentée par Jean-Pierre Buzon, M. Adolphe l.epreux, M. Lucien Robyn, M. Joseph Yerdonck ;

- Mr. Jean-Pierre Buzon, en nom personnel ;

- Mr. Lucien Robyn, en nom personnel ;

- Mr. Adolphe Lépreux, en nom personnel ;

- Mr. Charles Vandekei khove ;

- Mr. JM. Paul Keppenne ;

- Mr. Joseph Verdonck ;

- Mr. Donat Libotte ;

- Mr. Charles Huyttens ;

- Mr. Ghislain De Bruyn. 30-(1919/ 227 à 239)

Capital

Following the contribution of S.A. La Coloniale Belge described in the “Contribution” paragraph, it was attributed to the latter:

Mr. Buzon also received 3,500 founder's shares for his studies, projects, technical knowledge, research and work to achieve the constitution of the Company.

The remaining 1,000 capital shares were subscribed by:

Mr. Jean Buzon, 200 shares; Mr. Lucien Bobyn, 400; Mr. Adolphe Lepreux, 95 shares; Mr. Charles Vandekerkhove, 20 shares; Mr. Paul Keppenne, 25 shares; Mr. Joseph Verdonck, 200 shares; Mr. Donat Libotte, 5 shares; Mr. Charles Huyttens, 30 shares; Mr. Ghislain De Bruyn, 25 shares. Joseph Verdonck, 200 shares; Mr. Donat Libotte, 5 shares; Mr. Charles Huyttens, 30 shares; Mr. Ghislain De Bruyn, 25 shares.

20% of the shares subscribed were paid up, making 20,000 francs available to the Company. 30-(1919/ 227 à 239)

Contribution(s)

Object

First Board of Director

Changes of capital

1920 - On December 14, the capital was increased to 1,200,000 francs by the creation of 8,500 shares of 100 francs, which were subscribed for cash. In addition, 1,000 founder's shares were created. 21-(1925 T1/ 1133)

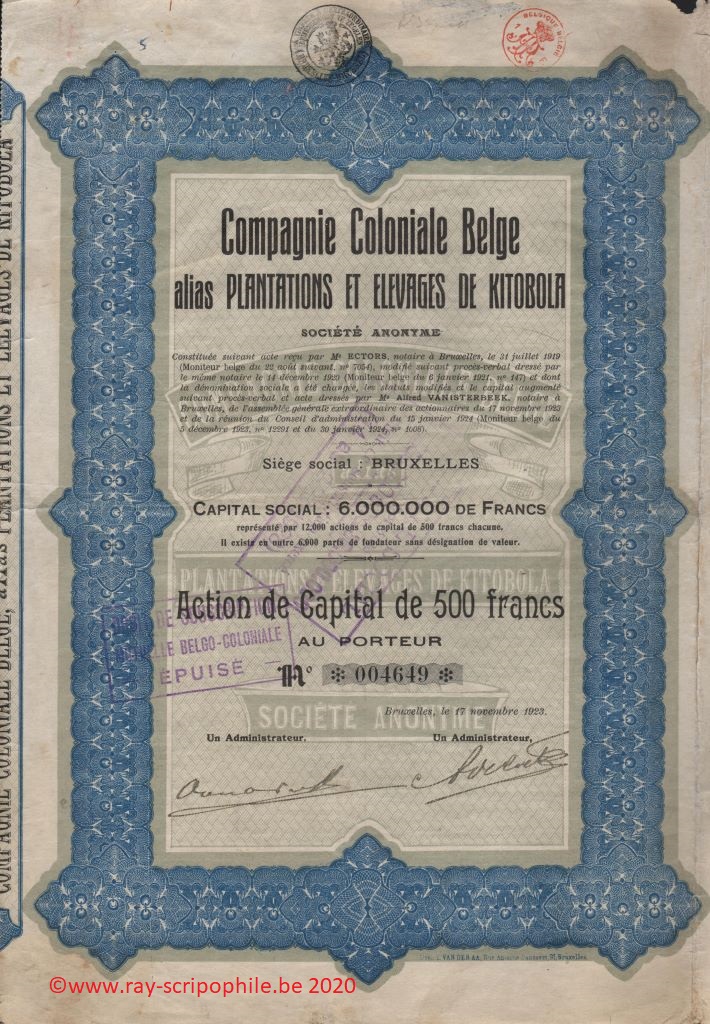

1923 – On November 17, the 12,000 capital shares of 100 francs existing were converted into 2,400 capital shares of 500-francs. The capital was then increased to 6 million francs by the creation of 9,600 shares with a par value of 500 francs, issued at 525 francs. 21-(1925 T1/-1133)

1925 – On November 23, the capital was increased to 15 million francs by the creation of 9,000 capital shares of 500 francs, issued at 550 francs, and 22,500 capital shares of 200 francs, issued at 220 francs, which were subscribed by the firm Raymond Buurmans, bankers in Paris and Brussels, and offered for subscription at the same price to former shareholders. 21-(1928 T3/-492/93)

1928 – On February 15, the capital was increased to 30 million francs by the creation of 27,000 shares of capital of 500 francs and 15,000 shares of capital of 100 francs. The 27,000 shares of capital of 500 francs were underwritten at a price of 650 francs by the firm A. E. V. Paligot et Cie, stockbrokers in Brussels, and offered at the same price to the former shareholders, on an irreducible basis at the rate of 3 new shares for 5 old shares: shares of capital of 500 francs or 200 francs or founder's shares..

The 15,000 shares with a par value of 100 francs were subscribed at a price of 130 francs by Mr. Jean Buzon, without subscription rights for former shareholders.

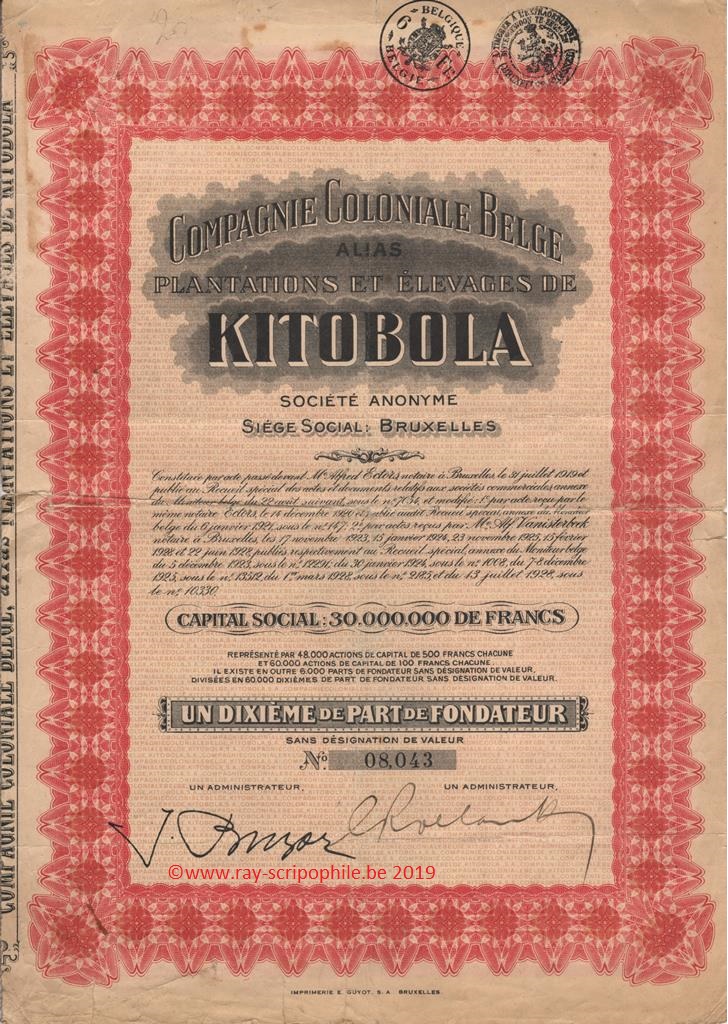

On the same date, the 22,500 shares with a par value of 200 francs were converted into 45,000 shares with a par value of 100 francs, i.e., at the rate of 2 new shares with a par value of 100 francs for each old share with a par value of 200 francs. As for the 6,000 founder's shares, on June 22, 1928, they were divided into 60,000 denominations of one-tenth of a share.

1935 – On June 28, the 60,000 capital shares with a par value of 100 francs were converted into 12,000 capital shares with a par value of 500 francs; each share of 100 francs now represented 1/5 of a share of 500 francs. The capital was then reduced from 30 million to 12 million francs by reducing the par value of the 60,000 capital shares of 200 francs. 21 -(1948 T7/ 2893)

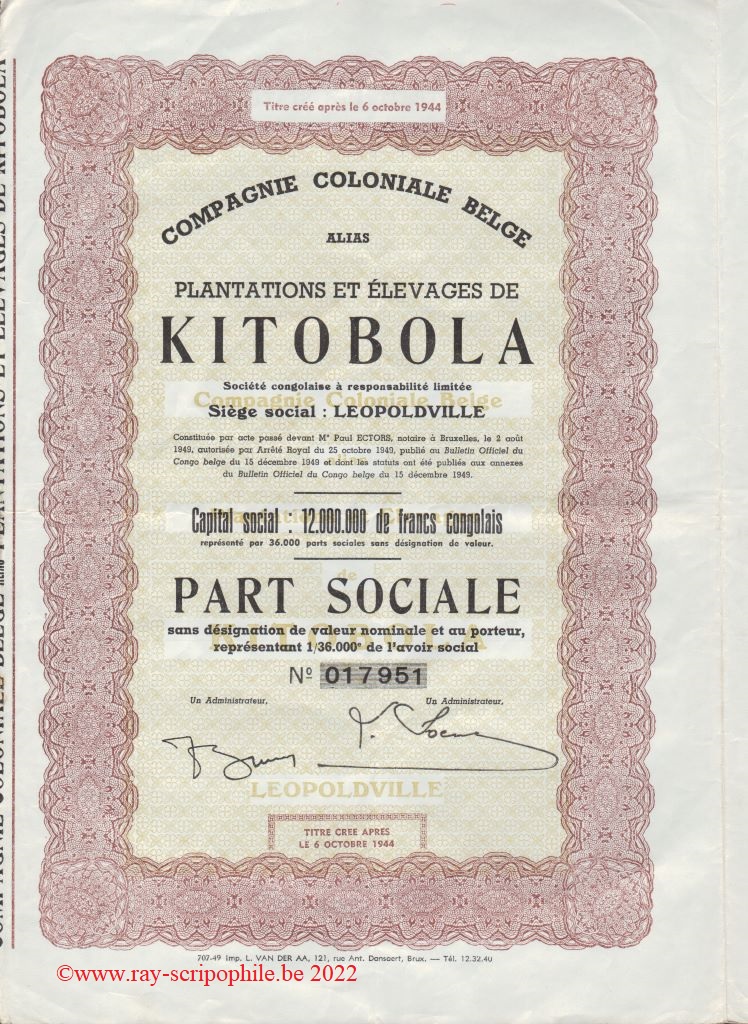

1949 - On August 2, the company was transformed into a Société congolaise par actions à responsabilité limitée, which succeeded the Société anonyme of the same name incorporated in Brussels on July 31, 1919.

The Belgian Société anonyme Compagnie Coloniale Belge contributed all its assets and liabilities shown in the balance sheet on December 31, 1948. In consideration of this contribution, the Belgian company was allotted 36,000 fully paid-up shares with no par value, to be distributed among its shareholders. 21-(1949 T5/ 2132 à 35)

Pursuant to the provisions of the Regent's decree of January 17, 1949, shares with a par value of 200 francs in the capital of Compagnie Coloniale Belge (Plantations et Elevages de Kitobola), a public limited company in liquidation, were exchanged for shares with no par value in the Congolese limited liability company "Compagnie Coloniale Belge (Plantations et Elevages de Kitobola)", at the rate of 2 shares in the capital of the Belgian public limited company in liquidation for 1 share in the Congolese company.

As from the same date, tenths of founder's shares in the Belgian company in liquidation were exchanged for shares in the Congolese company, in accordance with the Regent's decree of January 19, 1949. 21-(1949 T5/ 2132 à 35)

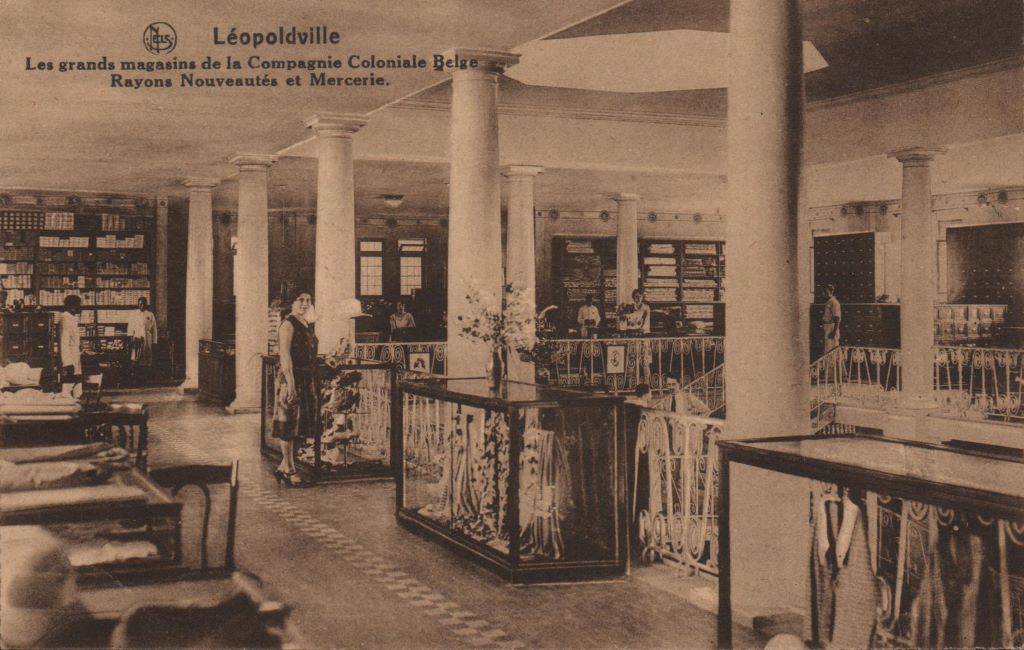

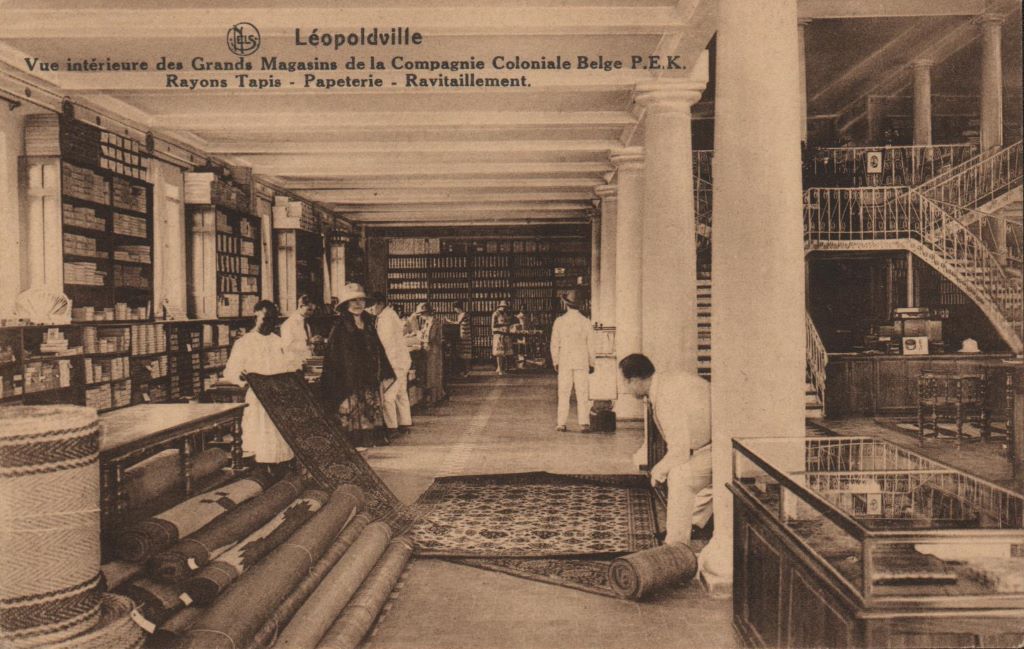

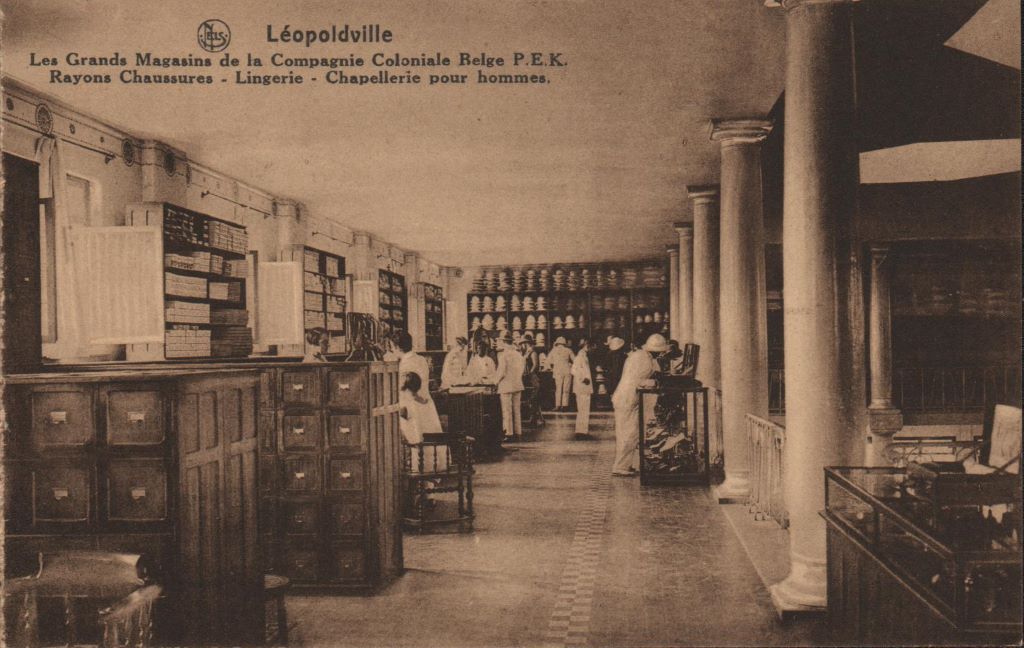

Nels postcards from the Compagnie Coloniale Belge P.E.K department stores around 1950

1950 – On June 14, the shareholders' meeting decided to increase the share capital from 12 to 18 million Congolese francs, without the creation of new shares, by incorporating a sum of 6 million constituting the capital gain on the revaluation of the buildings. It also decided to transfer 600,000 francs from the special reserve to the legal reserve. 21 -(1955/ T1/ 589)

1955 – On June 15, the Annual General Meeting decided to increase the company's capital from 18 to 21 million francs, by deducting 3 million francs from the extraordinary reserve. To represent this increase in capital, 6,000 new shares were created, identical to the existing shares, and allocated, fully paid up, to the holders of the 36,000 existing shares in the proportion of 1 new share for 6 existing shares.

1956 – On May 25, the capital was increased from 21 to 24 million francs by incorporating 3 million of reserves. To represent this increase, 6,000 new shares were created, identical to the old ones, which were allotted to the existing shares on the basis of 1 new share for 7 old shares, at no cost.

1957 – The Annual General Meeting of May 22 decided to increase capital by 3 million francs, from 24 to 27 million francs, by drawing on the extraordinary reserve. In consideration of this capital increase, 6,000 new shares were created, fully paid-up, of the same type, conferring the same rights and benefits as existing shares, and participating in the distribution of any profits as from January 1, 1957. These new shares were allotted to the owners of the 48,000 existing shares, in the proportion of 1 new share for S old shares.

1958 – On June 4, the Annual General Meeting decided to increase capital by 3 million francs, from 27 million to 30 million francs, by deducting 3 million francs from the extraordinary reserve, and to create 6,000 new, unlisted, fully paid-up shares of the same type, conferring the same rights and benefits as existing shares, and participating in the distribution of any profits as from January 1, 1958. The meeting decided to allocate the 6,000 new shares to the owners of the 54,000 existing shares, in the proportion of 1 new share for 9 existing shares. 21 -(1960 T2/ 1867-68)

1960 – Under the law of June 17, 1960, the Company opted for the Belgian system and took on the status of a société anonyme subject to the provisions of the Belgian coordinated laws on commercial companies. The name "Compagnie Commerciale Pek, alias Plantations et Elevages de Kitobola" was adopted on June 23, 1960. 21 -(1962 T2/ 1487)

After independence

From 1960 to 1974, the Company's activities in the Congo included the breeding of large and small livestock, the creation of food crops and cash crops. In particular, it operated the Kitobola plantation. It also held a stake in its Congolese subsidiary S.P.R.L. Pek Commercial.

In 1974, from the start of the exercise, the Zairianization measures announced in the last months of 1973 were implemented. According to a letter from the State Commissioner for Commerce of the Republic of Zaire dated January 20, 1974, these measures led to the attribution of exclusive ownership of the entire assets of our Zaire subsidiary to a Zaire citizen. Consequently, this implied the cancellation of the essential rights linked to the securities of our participation in the S.p.r.l. Pek Commercial .21 -(1975 T3/ 1831)

In 1975, S.A. Transport & Travel Investment launched a takeover bid for the outstanding shares of Compagnie Commerciale Pek, alias Plantations et Elevages de Kitobola, at a price of 537 francs per share. 21 -(1975 T3/ 1831)

Following the acquisition of a majority stake in Kitobola by S.A. Transport & Travel Investment, the latter intended to interest Kitobola in the development of tourism activities.

Later, it became a holding company.

The last dividend was paid in 1966 (fiscal 1965), i.e., 10 francs against coupon n°18. This was the very last dividend paid after 1960.

Event(s), participation(s)

Here you'll find PDF files of events from 1924 to 1960. Each file is no more than 2 pages long (in french).

Dissolution and liquidation

On May 4, 1998, Compagnie Commerciale Pek, alias Plantations et Elevages de Kitobola, was dissolved and put into liquidation following the sale of its participations. 2- (1999 page 243). There was a liquidation distribution allocated to the shareholders, the reimbursement was made against delivery of title with coupon 19 attached.