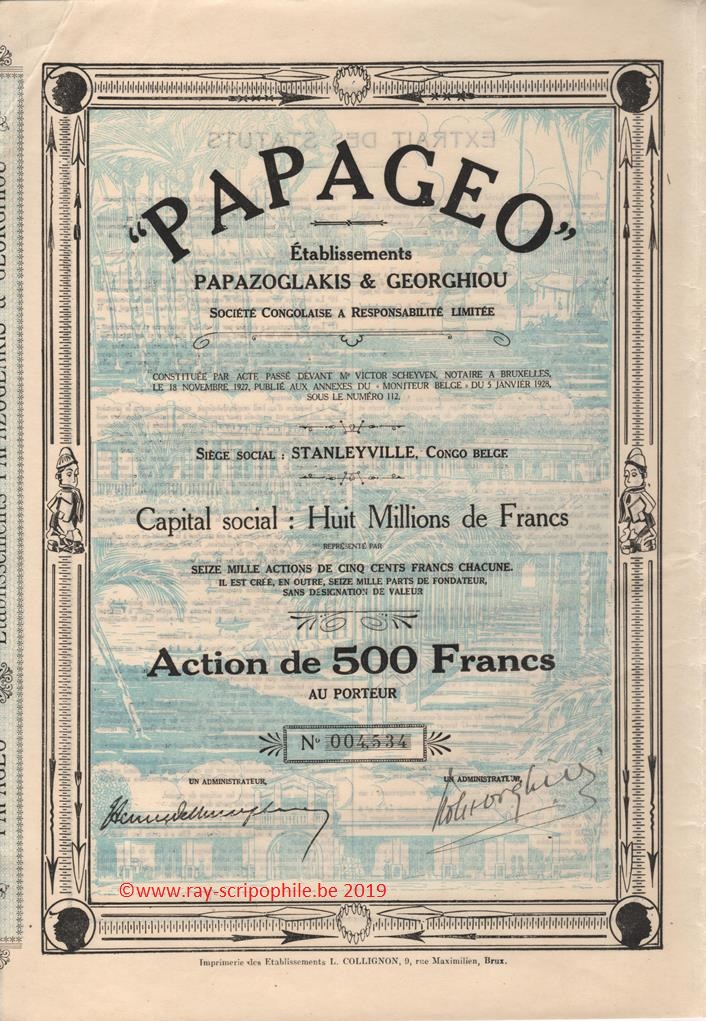

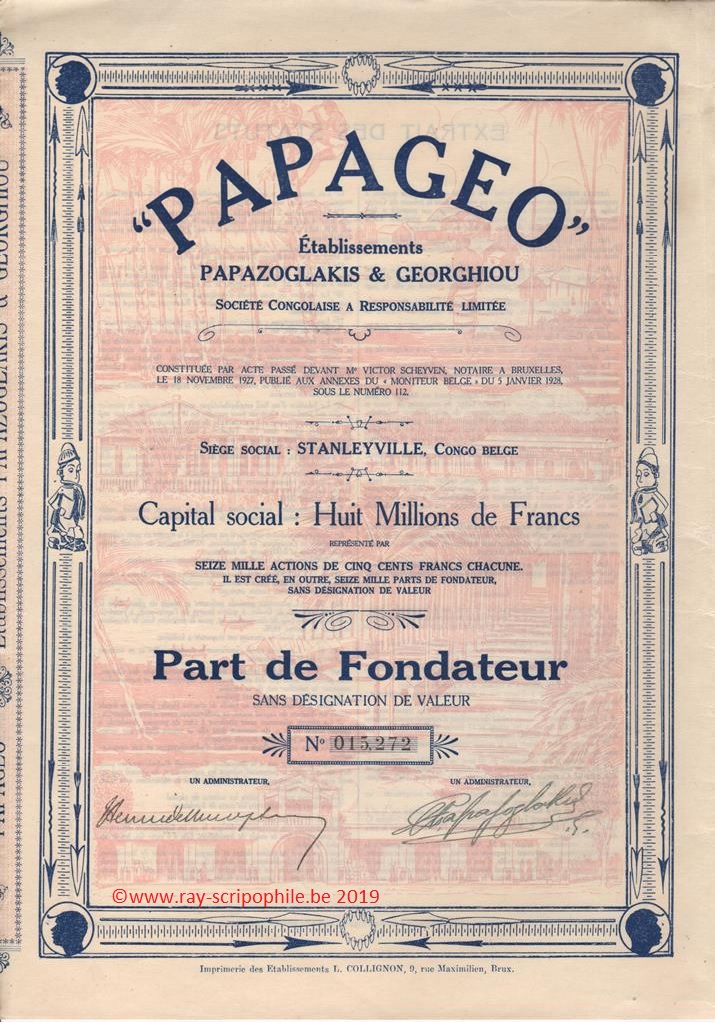

PAPAGEO - Etablissements Papazoglakis & Georghiou S.C.R.L.

Constitution

This Company was incorporated on November 18, 1927 with a capital of 8 million francs and represented by 16,000 shares of 500 francs. In addition, 16,000 founders' shares were created. The registered office was established in Stanleyville.renowned city in Kisangani

In consideration of the contributions described below made by the Papazoglakis and Georghiou General Partnership in liquidation, 10,500 fully paid-up shares and 8,000 founder's shares were issued in consideration of the contributions described below.

The remaining 5,500 capital shares were fully paid up and subscribed for by:

Société Anonyme de Stalle (1,000 shares), Hector Leclercq (1,000 shares), Henri de Hemptinne (1,000 shares), Octave Chalon (1,000 shares), Armand Delens (500 shares), Emile Dereume (400 shares), Robert Vanderkelen (300 shares), Richard Leerens (300 shares) (12-(5-01-1928)-112).

6,000 shares were put up for sale by public subscription at a price of FRF 875 from 11 to 20 June 1928 (21-(1929 T1)-1118).

Contribution(s)

Alex-Constantin Papazoglakis & Georghiou General Partnership, in liquidation, contributed to Société PAPAGEO:

1) A piece of land with a capacity of eighteen ares, located in Stanleyville.

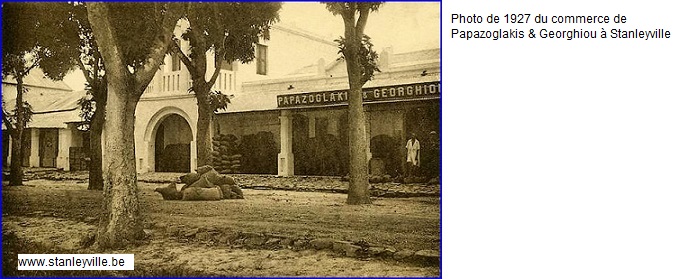

2) The buildings erected there and comprising, retail stores, wholesale stores, a floor for staff accommodation. Constructions built by the transferring company.

3) A piece of land located in Stanleyville, with a capacity of fifteen ares.

4) Buildings erected by the transferring company including offices, apartments, and garage.

5) A piece of land with a capacity of eight ares, located in Kindu.

6) The buildings erected by the transferring company, including in particular: retail shops, offices, apartments, etc.

7) A plot of land with a capacity of ten ares, located in Kindu.

8) The buildings erected by the transferring company, including a wholesale store with offices and apartments.

9) A plot of land in Kindu, with a surface area of ten ares.

10) The buildings erected there by Mr. Evripides Andréa, sold by the latter to the transferring company, comprising retail stores, apartments, and annexes.

11) A plot of land located in Ponthiervillerenowned city in Ubundu, with a capacity of 1,451 square meters.

12) The buildings erected there by the transferring company and comprising shops, offices, numerous apartments, and floors.

13) A plot of land located in Ponthierville, with a capacity of seventeen hundred and forty-four square meters.

14) The buildings erected by the transferring company and comprising: a hotel and a mechanical rice mill.

15) A piece of land located in Kindu, with a surface area of eighteen hundred square meters.

16) The benefit of all occupancy rights resulting from the concession granted by the colony on a land located in Kassongo and occupied by the transferring company.

17) The buildings erected by the transferring company including: a sheet metal store, a building comprising stores and apartments.

18) The benefit of all rights resulting from the concession granted by the colony on sixteen different pieces of land occupied by the transferring company and located respectively at Wanierukula, Bafwaboli, Bengamisa, Luiki, Kibombo, Nyangwe, Malela, Kilometre two hundred and seventy-five, Elila, Lokandu, Kirundu, Lubutu, Walikale, Massissi, Biondo, Ahusabik.

19) Buildings made of indigenous materials erected by the contributing company on these sixteen plots of land.

20) The benefit of an emphyteutic lease having taken effect on January 1, 1926 and ending on December 31, 1945 on a parcel of land intended for a palm plantation located on Tabakiri Island, eight kilometers upstream from Ponthierville, covering an area of four hundred and twenty hectares, granted by the government of the colony.

21) The buildings, constructions, plantations, works, equipment, tools, furniture, livestock belonging to the contributing company and located on this island.

22) The benefit of all these contracts, representations, rights, concessions, promises of concessions, clientele, goodwill, and organization.

First Board of Directors

The number of directors was set for the first time at 14 members, namely:

Messrs Edouard Michiels, Hector Leclercq, Henri de Hemptinne, Octave Chalon, Amand Delens, Richard Leerens, Alex Constantin Papazoglakis, Michel-Agathos Georghiou, Jean Georghiou, André Georghiou, Themis Papazoglakis, Charles Deleuze, René Rom, Jean Kallianzis.

Object

The establishment, in Africa and especially in the colonies of the Belgian Congo, of sales and purchase counters for any goods, any colonial products, the exploitation of rice fields, palm groves, plantations, all commercial, agricultural, and industrial operations. It could also be engaged in the exploitation of any deposit or development of concessions and properties that the company owned or could subsequently acquire.

To create headquarters, factories, and plants, to own, acquire and rent all buildings necessary or useful for its operation.

Take an interest, by way of transfer, contribution, subscription, financial participation or any other means, in any company or business whose object is directly or indirectly related to its corporate purpose or which are likely to promote or develop its corporate activity. It could merge with it (12-(05-01-1928)-112).

|

This photo comes from the website www.stanleyville.be , site dedicaced to the city of St Stanleyville renowned in Kisangani.

Capital increase, events, stock price

1929 - On January 16, the EGM decided to increase the capital by 8 million by creating 16,000 new shares of 500 francs. These new shares were subscribed jointly by Mr. Henri de Hemptinne and Mr. Octave Chalon at par with the condition to offer them to the owners of the old shares and founder's shares at the same price increased by 50 francs in the proportion of one new share for two old shares, without distinction of category. 6,000 of these shares were fully paid up; the other 10,000 shares were paid up to 20% (12-(17-02-1929)-1959).

The number of branches in the Congo was increased to 25 by the opening in Buta, capital of Uélé; Albertvillerenowned city in Kalemie, port of entry on Lake Tanganyika; Kongolo, etc. The number of sales increased, as did the number of tons of ivory sent to Antwerp.

The 420 hectares of the island of Tabakiri were completely covered with palm and coffee plantations. Work was started on a second island close to the previous one. A new concession of 200 hectares was added and the planting work was in full swing. The development of another 200-hectare concession also began.

Of the three concessions, each of 200 hectares, of the Leuze Plantations*, in which PAPAGEO has a major interest, one was completed and the other two were well advanced. The mechanical oil mill was being assembled. The motorized rice mill was in operation (21-(1929 T1)-1118).

* The Company intervenes (3,000 shares of 500 francs) in the formation of the capital of the Congolese company Plantations de Leuze, with a capital of 3,500,000 francs. This Company's land, located on the road from Stanleyville to Bafwaboli, covers an area of 600 hectares and is completely planted with "robusta" coffee and interspersed palm trees (21-(1931 T1)-1375).

As a result of the world economic crisis, a reduction in turnover, which fell sharply from 30 million per year to around 12 to 15 million francs, resulted in a financial imbalance caused by the disproportion between cash inflows and commitments made on the basis of normal business; this imbalance was then aggravated by :

a)- the reduction in the customers' ability to pay.

b)- discounting and credit restrictions imposed by banks which, by refusing to discount several local bills, inflated the "bills receivable" portfolio, making it impossible for the Company to make payments.

c)- the subsequent fall in the market for products (ivory, palm oil, palm trees, etc.), which had two consequences: 1° a reduction in the purchasing capacity of the indigenous people and, through a reduction in sales in the retail factoring factories; 2° the advances made on products in Africa, when they were shipped, calculated on the usual basis, were higher than the realizable value after arrival in Antwerp, hence the need to reimburse the difference.

d)- the general and operating costs could not be reduced within the same period of time and in the same proportion as the turnover, so that it was necessary to pay charges which were too heavy in relation to the present possibilities.

(e)- finally, the absolute necessity to continue the development of the coffee plantations, to pay the workers, and to continue to make substantial and continuous capital investments to avoid the illnesses that can result from lack of maintenance alone and the almost total loss of fixed assets.

It could be concluded from the above that the current cash flow crisis made the general situation of the business very difficult, but PAPAGEO was able to meet its commitments as long as its creditors gave it time, because in these days of crisis it was difficult to sell shares, land and buildings unless the buyers agreed to price conditions that were really disastrous for the seller. As a result, all possible effort was limited to selling stocks, which became more and more difficult by the day (21-(1930 T1)-1288).

The share was listed on the Brussels stock exchange: prices on December 31, 1928 and 1929, respectively 925 and 500 francs.

Dissolution, bankruptcy

In 1930, due to a lack of liquidity, the Company was declared bankrupt on summons (judgment of the court of first instance of Stanleyville (Note M. Coget) (My thanks to F Maeder of Berne for this information).