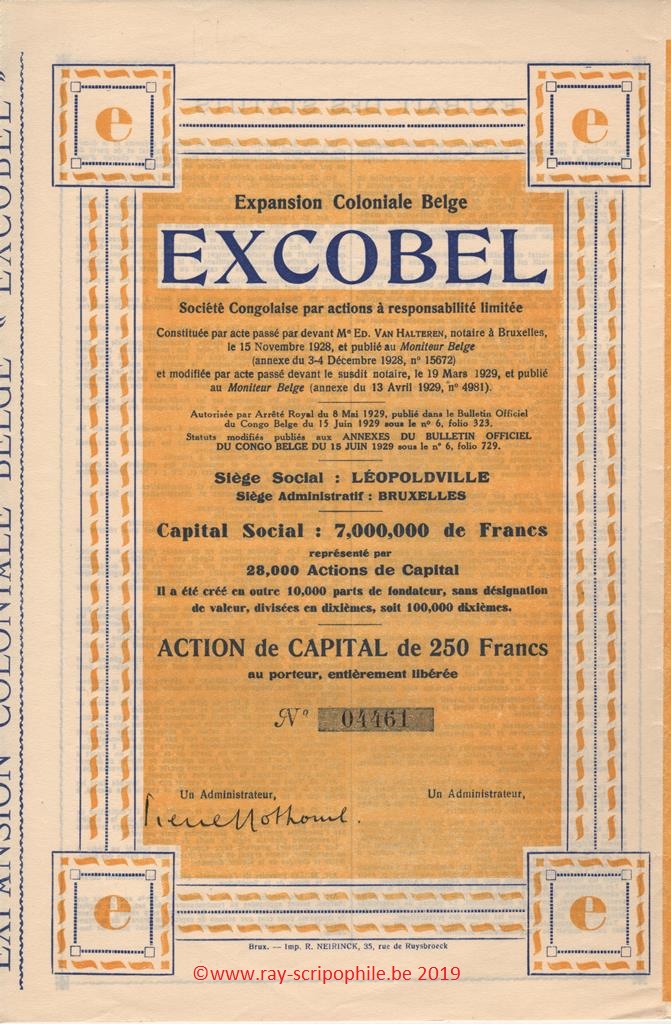

Expansion Coloniale Belge - EXCOBEL S.C.A.R.L.

Constitution

This Company was incorporated on November 15, 1928 with a capital of seven million francs represented by 3,500 shares of capital series A of 10 francs and 27,860 shares of capital series B of 250 francs. In addition, 10,000 founder's shares were created and divided into tenths; these were distributed among the subscribers according to their special agreements. The registered office was established in Elisabethville and the administrative headquarters in Brussels.

Series A and B shares with a paid-up capital of 20%, i.e. 2 francs for series A and 50 francs for series B, were subscribed by:

Marcel Loumaye (175 series A, 1,993 series B), Société Belge d'Entreprises Coloniales (1,075 series A, 3,957 series B), Pierre Nothomb (950 series A, 1,562 series B), Max Everarts de Velp (175 series A, 3,793 series B), Edgar Lonchay (100 series A, 1,996 series B), Luc Hommel (175 series A, 1. 693 Series B), Carlo de Mey ( 125 Series A, 395 Series B), Baron Maurice Fallon ( 100 Series A, 1,996 Series B), Herman de Vries de Heekelingen (50 Series A, 1,198 Series B), Henri-Charles-Marie-Gerard-Leon Capelle (100 Series A, 1,996 Series B), Henri Reners. ( 150 Series A, 1,194 Series B), Fernand Wagemans-Lequime (75 Series A, 397 Series B), Baron Adrien de Giey (50 Series A, 798 Series B), Baudouin-Joseph-Albert Montens d'Oosterwyck (25 Series A, 399 Series B), Robert van den Bosch ( 50 Series A, 998 Series B), Jean Lefèvre (75 Series A, 1. 597 Series B), Gerard Bertouille ( 25 Series A, 499 Series B), Armand Wasseige ( 25 Series A, 199 Series B), General Partnership under the name Jacobs and Hertoghe (600 Series B), Xavier Gheysens ( 400 Series B), Paul Wauters (200 Series B).

First Board of Directors

The number of directors was set for the first time at ten, i.e.:

Messrs. Marcel Loumaye, Pierre Nothomb, Max Everarts de Velp, Henri Reners, Baron Maurice Fallon, Herman de Vries de Heekelingen, Luc Hommel, Jean Lefèvre, Fernand Wagemans-Lequime, Edgar Lonchay

Object

The purpose of the Society was to participate in the incorporation of various colonial affairs. It could extend its activity to businesses created or to be created in the Belgian Congo and particularly to real estate businesses. Moreover, its corporate purpose included all operations in colonial affairs in general, the expression taken in its broadest sense and aimed at the extraction of raw materials, crops and plantations, real estate and commercial, industrial, financial, mining, forestry and other businesses, as well as any business that even indirectly supports one of these purposes (12(03/04-12-1928)-15672).

Event(s), changes, and transformations of capital

On March 19, 1929, the EGM decided to cancel the 3,500 Series A capital shares of 10 francs and to replace them with 140 capital shares of 250 francs of the same type as the Series B shares created when the Company was incorporated. The capital of 7 million was represented by 28,000 capital shares of 250 francs. The exchange ratio was set at one new share of BEF 250 for 25 shares of BEF 10 capital. The registered office was transferred to Leopoldville (12(13-04-1929)-4981).

Excerpts from Reports – Recueil Financier

1929 - Despite very unfavorable circumstances, the first financial year ended in a satisfactory manner. The Company participated to an exceptionally large extent in the formation of its subsidiary, Société Foncière Coloniale Belge (Foncobel), created on June 4, 1929, with a capital of 2 million francs*. This Company owned more than 1 hectare of land and buildings located in the center of Leopoldville. Despite the current crisis in the Congo, it earned a very satisfactory income from the rent on its buildings.

After a long and meticulous study of a project that had been presented by Mr. Hessel and Mr. Vincent, the Company partnered with these gentlemen to operate a 500-hectare logging concession to which Mr. Hessel was entitled because of his years of service to the Colony. Mr. Hessel's unanimously recognized competence in forestry operations and the results achieved to date allowed us to look to the future of this business with confidence. It was hoped that the association with Mr. Hessel and Mr. Vincent would soon take the form of a Congolese Limited Liability Company. The Excobel took an important participation in the capital increase of the Société Immobilière Commerciale et Agricole du Congo (S.I.C.A.). It had used part of its liquid assets to acquire first-class colonial and rubber stocks. These securities, already purchased during the price reaction period, have, against all expectations, suffered a further capital loss. They were entered in the balance sheet at their cost price, as the troubled circumstances and the deep crisis prevented any definitive valuation of these securities due to the continuous price fluctuations. For this reason, the profit before depreciation, i.e. BEF. 34,378.89, was entered under depreciation on portfolio (21-(1930 T1)-1286).

*The Société Expansion Coloniale Belge (Excobel) contributed to Foncobel its studies, procedures, and negotiations, for which significant sums were paid. In remuneration of this contribution, it was allocated 200 fully paid-up capital shares of 500 francs each.

Of the 4,000 shares issued, the Congolese company Expansion Coloniale Belge (Excobel) took a stake of more than 60% (21-(1931 T1)-663).

1930 - The intense crisis in both Belgium and the Belgian Congo during the year hindered the realization of the Society's program. Its subsidiary, Société Foncière Coloniale Belge Foncobel, closed its first financial year on June 30, 1930 with a profit balance of BEF. 97,336.69, which was allocated to various amortizations. On the other hand, the crisis enabled it to acquire, on very advantageous terms, a large group of buildings located in the center of Leopoldville and a 169-hectare estate located 7 km. from the center of that city.

Because of the economic and social situation in the Congo, the colonial government could not immediately grant Mr. Hessel the 500-hectare concession he had requested in the Mokame region on the Oubanguialso writes Ubangi tributary of Congo riverRiver (Equateur). The rights of establishment and timber cutting that had been granted had nevertheless made it possible to undertake logging operations there, the development of which had been severely hampered by the crisis. These circumstances prevented the implementation of the program that Mr. Hessel and Mr. Vincent had undertaken to carry out. Consequently, using the rights conferred on it by the agreement between it and these gentlemen, the Company endeavored to liquidate the interest in the case in the best interests of the Company. The portfolio, carried in the balance sheet for BEF. 289,802.91, included the shareholding in the capital of Société Immobilière Commerciale et Agricole du Congo (S.I.C.A.) and the rubber assets acquired in 1929. This portfolio had suffered a strong depreciation. However, the Company considered that the current prices were unjustified and that the current troubled circumstances did not allow a definitive estimate to be made; this portfolio was valued in the balance sheet at cost price, after deduction of the depreciation of BEF 34,378.89 applied to the profit balance for the year 1929 (21-(1931 T1)-1373).

On July 10, 1931, the capital of Foncobel was increased by BEF 500,000 to BEF 2,500,000 by creating 1,000 new shares of BEF 500 each, issued at par with dividend rights from 1 July. These shares were subscribed to by the Belgian Colonial Expansion Company (Excobel), which undertook to make them available to the former shareholders in the proportion of 1 new capital share for every 4 old capital shares. There were also created 2,000 founder's shares without designation of value, with dividend rights from 1 July 1931, which were remitted to Mr. Henri Reners, stockbroker, in Liège, to be distributed, in accordance with special agreements, among the partners holding Excobel founder's shares, as remuneration for the procedures, negotiations and agreements with a view to the subscription of the new capital shares (21-(1932 T3)-392).

Dissolution and liquidation

On September 30, 1931, the EGM decided to dissolve the Company early and the liquidation was entrusted to Mr. Pierre Nothomb, lawyer in Brussels, and Mr. Henri Reners, stockbroker in Liège, appointed liquidators (12(23-10-1931)-14358).