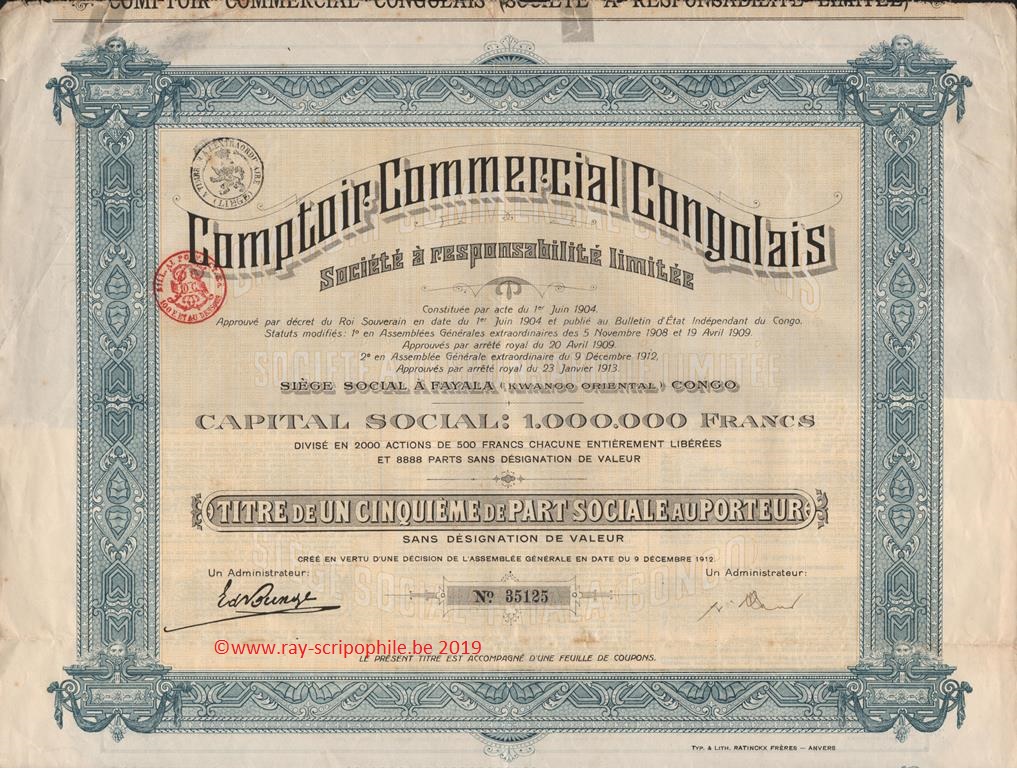

Comptoir Commercial Congolais S.R.L.

Constitution

Following the Company created on July 18, 1895, put into liquidation on February 24, 1898, reconstituted on February 26, 1898; then dissolved on June 1, 1904 and reconstituted the same day. The Comptoir Commercial Congolais modified its capital by a representation of 4,000 shares without nominal value. The Independent State of Congo received 1,000 new shares for the 2,400 old shares: 1,000 new shares to the holders of the 2,000 old shares and 2,000 new shares for the 2,000 old founder's shares

Contribution(s)

Comptoir Commercial Congolais S.C.R.L., incorporated on February 26, 1898, in liquidation, represented by the liquidators and holders of the above shares, contributed to the new Company the concession belonging to it formed by the WambaThe Wamba is a river in Central Africa and a tributary of the Kwango, thus a sub-tributary of the Congo River through the Kasai. The territory of Wamba is a deconcentrated administrative entity of the Haut-Uele province in the Democratic Republic of Congo. See: https://fr.wikipedia.org/wiki/Wamba River Basin and in accordance with its arrangements with the Independent State of Congo, with rights and obligations, as well as all its assets and liabilities without exception.

First Board of Directors

The first Board of Directors was composed of seven people, namely:

Alexis. Mols, Prospert Van Geert, William Ford Schmoele, Louis Hoeckle, Léonce Groetaers, Edmond-François-Pierre de Wael.

Object

To carry out, within the widest possible limits, all commercial operations involving imports and exports, armaments, commercial and industrial operations useful or necessary to its trade or industry (12-(09/08/1895)-2445) (06/03/1898)-766) (15/01/1898)-210) (30/06/1904)-3538)).

Changes in capital

On November 5, 1908, 2,000 shares of 500 francs each, 5% fixed, redeemable, and 2,000 new shares were created. The shares were issued at par with an allocation of one share per share. The capital was then one million represented by 2,000 shares of 500 francs each and 6,000 shares with no par value.

The EGM of December 9, 1912 decided to issue a loan of one million francs in 2,000 bonds of 500 francs. It also decided to create 2,000 shares (5/5ths) which were allocated to the subscribers of the 2,000 bonds; in addition it created 888 shares which were given to the Société Bruxelloise pour le Commerce du Haut-Congo in replacement of the 10% interest due to it on the profits of the Company for the transfer of its property in Muenesita (21-(1913 T2) -585). The share capital was then represented by 2,000 fully paid-up shares of 500 francs each and 8,888 shares (5/5th) without designation of value.

On July 22, 1914, 8,000 shares were created, of which 4,000 were intended to replace the reduction of interest on bonds and 4,000 were intended to be exchanged for bonds. In the same year, the 2,000 preference shares of 500 francs were exchanged for 4,000 shares and 2,400 additional shares created were given to the Colony of the Belgian Congo in return for the waiver of its annual fee of 30,000 francs. The company's assets were then represented by 23,288 full shares divided into 116,440 fifths (21-(1919 T1) -2023/24).

Event(s), participation(s)

If we take over the activities of the previous companies, the first balance sheet of July 1896 showed a profit of 337,000 francs, which made it possible to distribute a first dividend. It can also be seen that three other profitable years made it possible to distribute dividends.

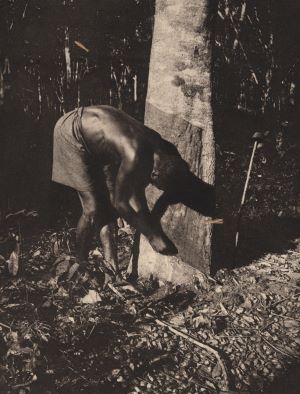

From 1902 onwards, the company operated the concession of the Wamba river basin for a term ending in 1924. Its main activity was rubber harvesting.

In 1905, the Company was authorized to occupy, on a precarious basis, the Southern Kwango, including government posts. The Cie Bruxelloise du Haut-Congo ceded to it its property in Muenesita on the Kwango, in return for 10% of the profits charged by the Comptoir Commercial Congolais.

According to the 1909 report, the rubber harvest in 1908 was 259 tons. The company had 24 factories, 3 steamboats and 12 whaling ships. It organized the harvesting of rhizomes or rubber from grasses, a kind of root that can be found about 20 centimeters deep and whose bark produces gum. It collected 205 tons in 1908 (21-(1910 T1) -46/47).

Incision of a rubber tree to harvest the latex (31)

On March 7, 1910, the Comptoir Commercial Congolais created the Société Exploitation Industrielle du Caoutchouc with a capital of 600,000 francs in 6,000 shares of 100 francs, entirely subscribed by the C.C.C. (21-(1911 T1) -51).

From 1914 to 1918, the measures taken to reduce costs to the strict minimum bore fruit, but in 1917 a further fall in rubber prices led to a loss; moreover, costs increased as a result of the rise in transport costs, insurance, etc. (21-(1919 T1) -2024).

In 1918, its subsidiary, Société pour l'Exploitation Industrielle du Caoutchouc, ceased operations due to the high cost of transporting and processing the rhizome whose products were no longer in demand; Comptoir Commercial Congolais took over the assets and liabilities of its subsidiary (21-(1919 T1) -2024).

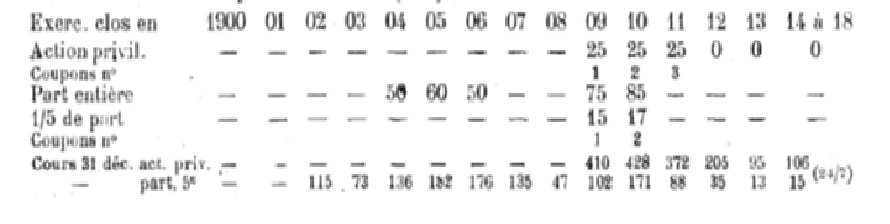

Dividends and quotation

(21-(1919 T1) -2025).

Merger, Dissolution and Liquidation

On October 14, 1919, the Company was put into liquidation and its assets were contributed to the Compagnie du Congo Belge, which assumed all the liabilities and costs of liquidation. The shares were exchanged at the rate of 2 shares Compagnie du Congo Belge for 15 fifths of Comptoir Commercial Congolais shares. This merger was made necessary by the fact that the Company had to create new resources to liquidate its bank debt and to build up working capital to cover the accumulation of stocks in Africa, the shortage of means of transport and the rubber crisis (21-(1920 T1)-1346).