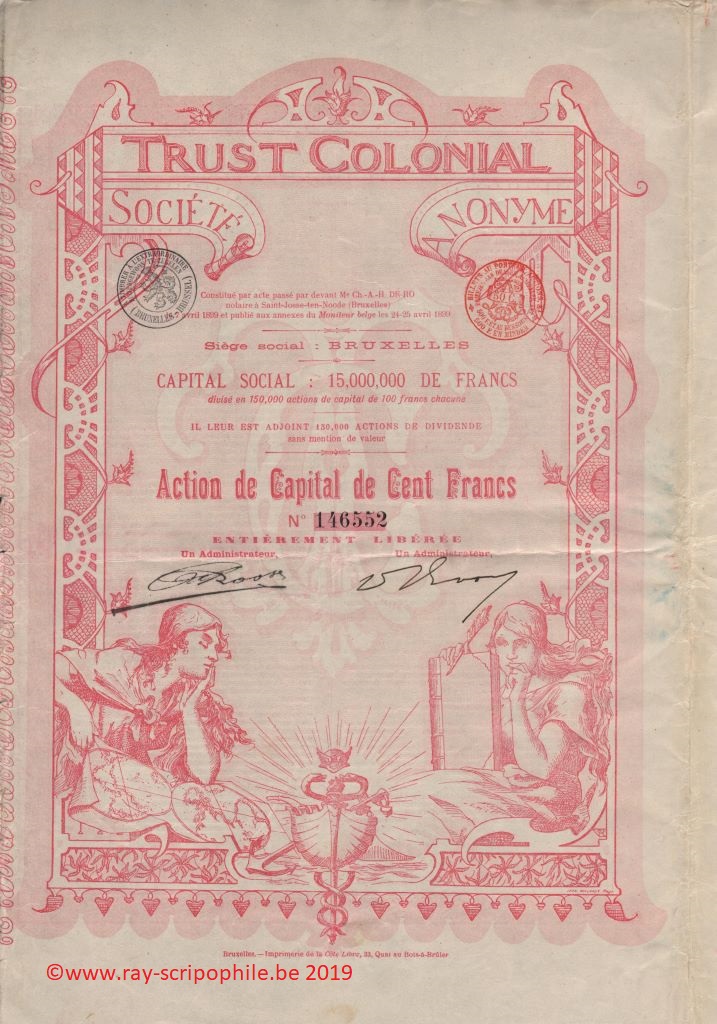

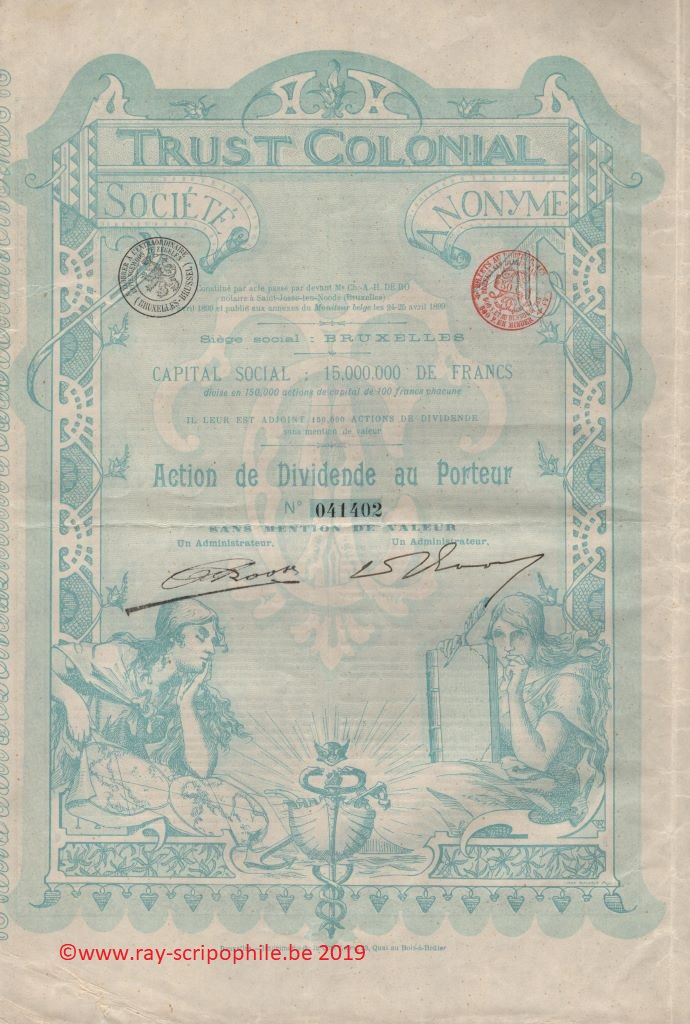

TRUST COLONIAL S.A.

Constitution

The Trust Colonial was constituted on April 7, 1899, the capital of 15 million francs was represented by 150,000 shares with a capital of 100 Belgian francs; in addition, 150,000 dividend shares were created, half of which were distributed as an advantage to L'Africaine and the other half to the other subscribers, in proportion to their subscriptions.

Board of Directors

Object

Change in capital, event(s), shareholding(s), quotation

Report by L'Africaine of January 30, 1900. - The Trust Colonial was intended to provide financial assistance to L’Africaine for the carrying out of current or new business, and this purpose was largely achieved. The Trust has secured considerable benefits and there is good reason to be optimistic about the expected results (21-(1900 T1)-115).

Report of November 1901. - The debtors and bankers included in the balance sheet for an amount of 4,428,304.16 represented for the most part the current account of L'Africaine. The composition of the portfolio was not communicated. Details of the participations are given below:

1904 - The claim of about 5 millions on the African was indicated as secured. The Participations shown on the balance sheet mainly represented advances towards the Bolivian railroad business, which appeared to be on track. The Quélimane railway was to be built, which would allow the land to be realized (21-(1905 T1)-652).

1905 - The composition of the portfolio was always ignored. In the profits for the year, the income from the portfolio was too small to be shown separately. Subsidiary records mentioned some hope for a better future (21-(1906 T1) -671).

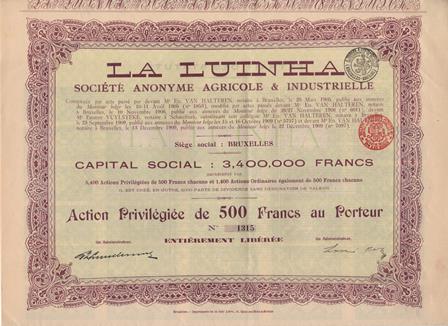

1909 - The administration hoped to be able to offset the assets and liabilities to free up the 22,000 shares of Cie d'Entreprises Coloniales which could be distributed to the shareholders. The Luabo affair will be reconstituted; the Trust's claim reduced from 500,000 to 250,000 francs will be paid; the current Luabo shares are worthless, and the rest of the portfolio was worth very little (21-(1910 T1) -812).

1910 - The Colonial Trust could not yet say whether the assets, apart from the 22,000 Cie d´Entreprises Coloniales shares, would be sufficient to settle the liabilities (21- (1911 T1) -1000). (21-(1911 T1) -1000).

1911 - On March 6, the capital was reduced to 1,500,000 francs and the nominal value of the shares was reduced to 10 francs (21-(1912 T1) -1569).

Share price at 31/12 (Belgian francs) (21-(1912 T1)-1569/70)

Exercices Act cap. Act div. | 1899 70 40 | 1900 41 19 | 1901 28 14 | 1902 19 7 | 1903 20 6 | 1904 15 4 | 1905 15 5 | 1906 14 3 | 1907 9 2 | 1908 7 1 | 1909 4 1 | 1910 6 1 |

Dissolution and liquidation

The Trust Colonial was dissolved, and the company went into liquidation on December 29, 1911 (12-(19/01/1912)-431).