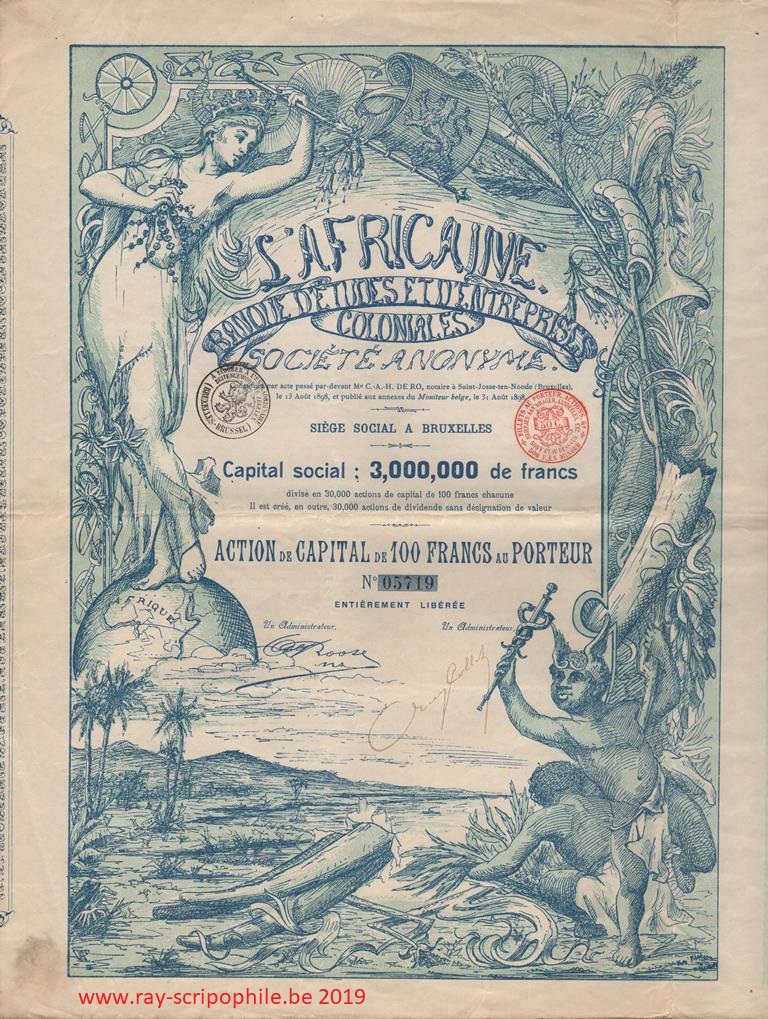

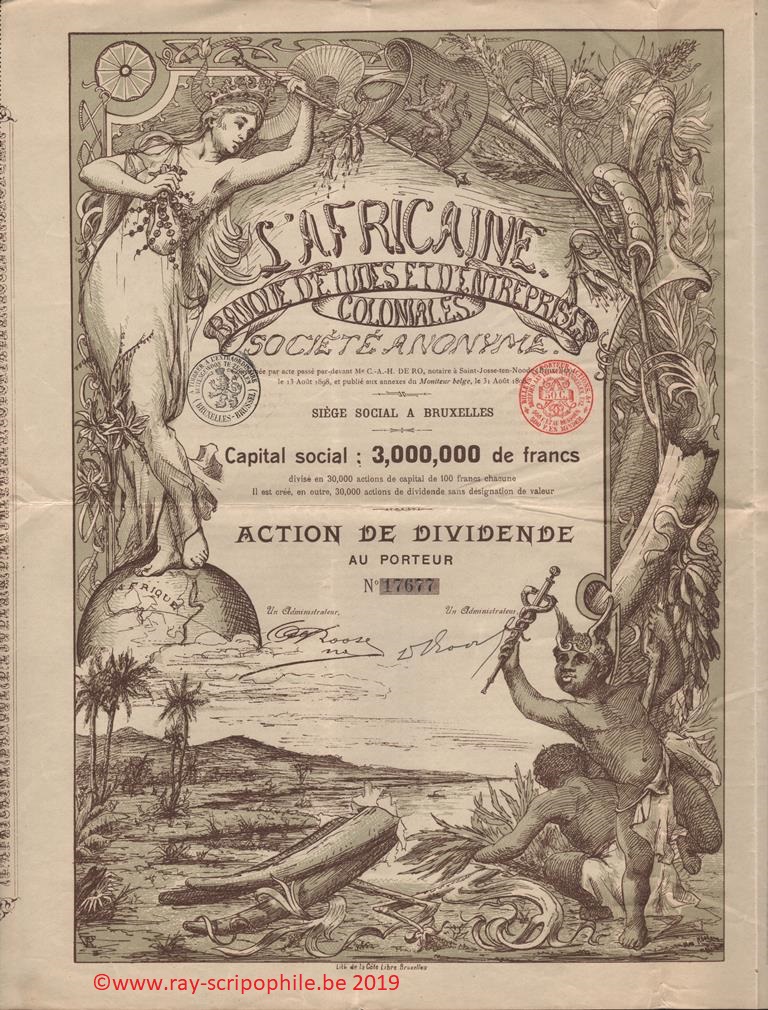

L'AFRICAINE, Banque d'Etudes et d'Entreprises Coloniales S.A.

Constitution

This Company was incorporated on August 13, 1898 with a capital of 3 million, divided into 30,000 shares with a capital of 100 francs; in addition, 30,000 dividend shares were created, allocated to the comparators according to their agreements. The registered office was established in Brussels.

The 30,000 capital shares were subscribed by 118 shareholders

10% of the shares were paid up on subscription; the amount of 300,000 was made available to the new Company.

Object

Change in capital, event(s), shareholding(s), dividend(s), quotation

The activity of the Company came from its portfolio of various young companies, mostly colonial, for an approximate value of 3,700,000 francs.

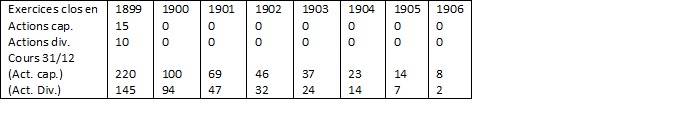

The first financial year of 1899 allowed the distribution of a dividend of 15 and 10 francs for capital and dividend shares, respectively. The rates at 31 December were BEF 220 for capital shares and BEF 145 for dividend shares (21-(1900 T1) -54/55).

Report of January 1901. - The situation on the financial market prevented any transactions on portfolio securities and, as most of the subsidiaries were too young to make direct profits, the profit for the year was sharply reduced. In 1899-1900, the Bank created: the Cie d’Inhambane, the Cie commerciale et coloniale de la Kadeï Sangha, the Cie générale Franco-Malgache, the Cie de la Mobaye, the Cie « l’Abuna », the Comptoir commercial du Benguella (21-(1908 T1) -536/537).

1903 report. - Subsidiary business was still in its infancy.

Report of January 1904. - The Company took a 1/5 interest in the Syndicat Minier de Shiloango (Mayumbe), formed on its initiative by the State of Congo, interested for 3/5 and an American group (1/5), and whose aim was mining research between Lukula, Congo as far as Manyanga and the northern border.

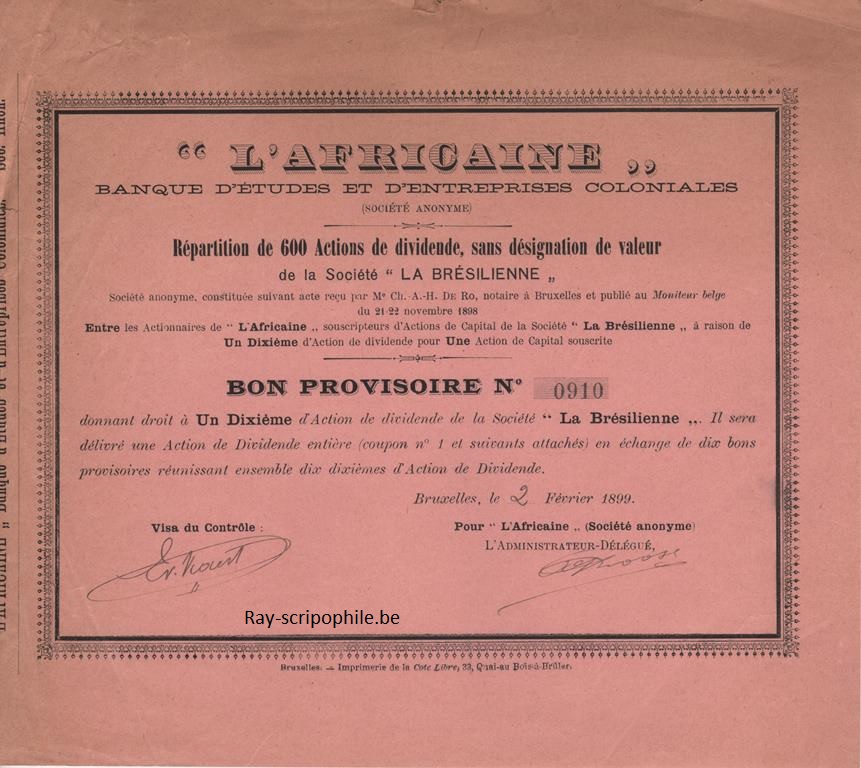

This voucher made it possible to receive one tenth of a dividend share from Société La Brésilienne. A full dividend share (coupon 1 attached) was issued for 10 provisional vouchers

Huge deposits of gold-bearing pyrites, quartz sands and veins were discovered, yielding 36 to 240 grams per ton (21-(1908 T1) -536/537).

Report January 1905. - The loss on operations in 1903-04 was 17,231.54 francs, but it rose to a total of 2,695,752.09 francs by amortizing 722,584.80 francs on the portfolio. Liquidation was ruled out. The administration believed the Company possessed elements that could give its shares a higher price than the market price (21-(1908 T1) -536/537).

1906 - The Bolivian company was obtained by an Argentinean trade union. The Company hoped to obtain another concession as a preference in compensation for the sacrifices it had made. It appeared, however, that the expenses incurred in this regard did not exceed 100,000 francs. In fact, the assets of L'Africaine belonged to the Trust Colonial.

Capital realignment project

A financial group would subscribe at par for the 5,000 priorities and receive the 5,000 new profit-sharing shares. The Trust Colonial waived, against the 10,000 new preference shares, all its rights of claim against L'Africaine, to the exclusion of any rights resulting from payments it might be required to make as guarantor of L'Africaine; it being further understood that it retains ownership of the pledges it may have made to third parties for the benefit of L'Africaine.

- The 5,000 priorities shares must be subscribed by the end of November 1906, failing which the whole combination will be cancelled, and indeed it was (21-(1908 T1) -536/537).

1907 - In January, L'Africaine was simply considering the conversion of the 30,000 shares into securities with no par value (21-(1908 T1) -536/537).

L'Africaine owed the Trust Colonial 5,290,000 francs. She handed over her portfolio of securities and holdings, estimated at 3,374,000 francs, and kept her Trust Colonial shares (21-(1908 T1) -536/537).

Dividend(s), cotation

|

Dissolution and liquidation

The L’Africaine, unable to pay her debts, ceded all her assets to the Trust Colonial, her only creditor. The Company was dissolved on September 28, 1908 and was thus effectively liquidated (21-(1909 T1)-33).