Compagnie Financière Belge et Coloniale S.A.

Constitution

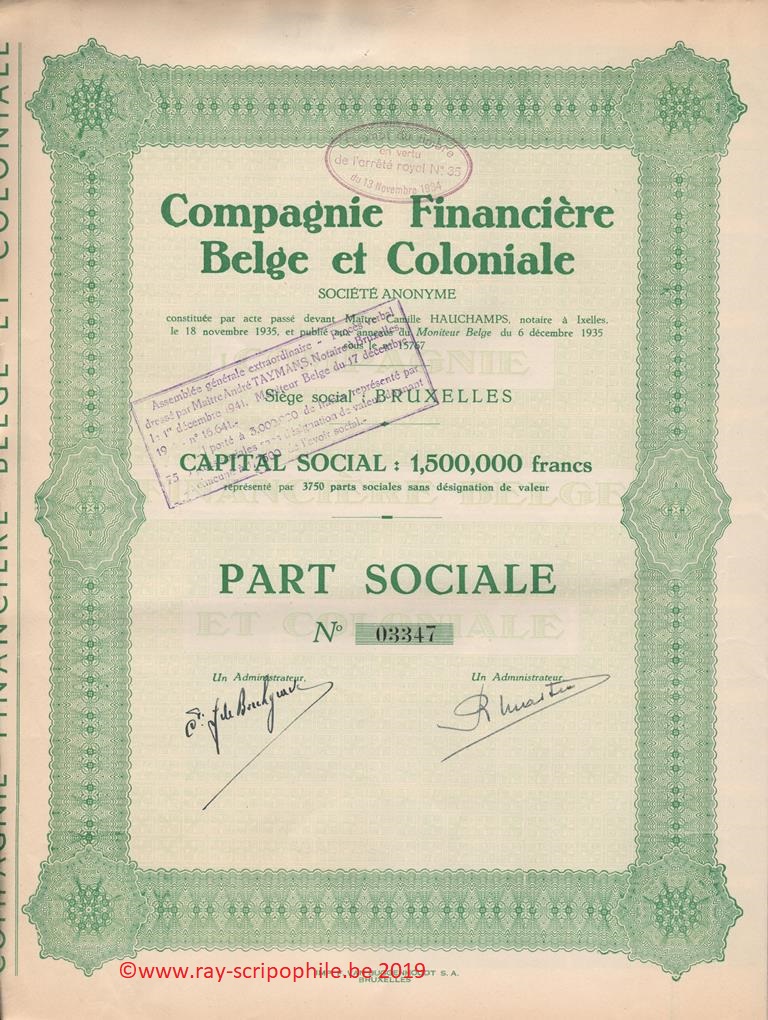

The Compagnie Financière Belge et Coloniale was incorporated on November 18, 1935, following the Royal Decree of July 9 1935, and its registered office was established in Brussels. Banque Belge et Coloniale transferred to Compagnie Financière Belge et Coloniale all its shareholders' shares, participations constituting the portfolio of the said bank, with the exception of securities or shares which the law authorized deposit banks to hold.

The capital of 1,500,000 francs was represented by 3,750 shares without designation of value, this capital was subscribed as follows:

Contribution of an amount of 1,480,000 francs by Banque Belge et Coloniale.

Subscription at the price of 400 francs of 50 shares by 6 comparators:

Messrs. Léopold Dhanis, 19 shares; Francis Dhanis, 19 shares; Jacques Ancion, 3 shares; Jean de Borchgrave d'Altens, 3 shares; Pierre Le Brun, 3 shares; Raymond Martin, 3 shares.

Contribution

The Banque Belge et Coloniale brought in its portfolio either:

Metallurgical stocks: capital and dividend shares of National Foundries and Stove Works, for 1 million francs.

Colonial securities: shares of Comité National du Kivu, shares of Société Auxiliaire Agricole du Kivu, shares and shares of founder Société Minière de l'Afrique Centrale, tenth share of founder Société de Recherches Minières au Katanga, for 197,500 francs.

Commercial companies: shares in Union Commerciales et Industrielles, shares in Agence Nationale d'Assurance, for 143,000 francs.

Miscellaneous company assets: capital and founder's shares in Usines Ribby, capital shares in Société Industrielle d'Energie et de Transport, for 136,500 francs.

All together for a total of BEF 1,480,000. As remuneration for this contribution, 3,700 fully paid-up shares were allocated to Banque Belge et Coloniale.

First Board of Directors

The number of directors was for the first time set at four:

Messrs. Jacques Ancion, Pierre Le Brun, Jean de Borchgrave and Raymond Martin.

Object

The Company's purpose, both for itself and on behalf of third parties, was to take an interest, in Belgium and abroad, by way of subscription or purchase, in all commercial, industrial, financial, real estate, maritime, colonial and agricultural enterprises. This enumeration is enunciative and not limitative.

The Company could take part in the management, supervision and liquidation of all companies, whether privately owned or incorporated as associations or commercial companies. It could grant and contract any loan in the form of the issue of bonds, cash bonds, credit facilities with or without real guarantees or other (12-(06/12/1935)-15767).

Event(s), modification(s) and transformation(s) of the capital

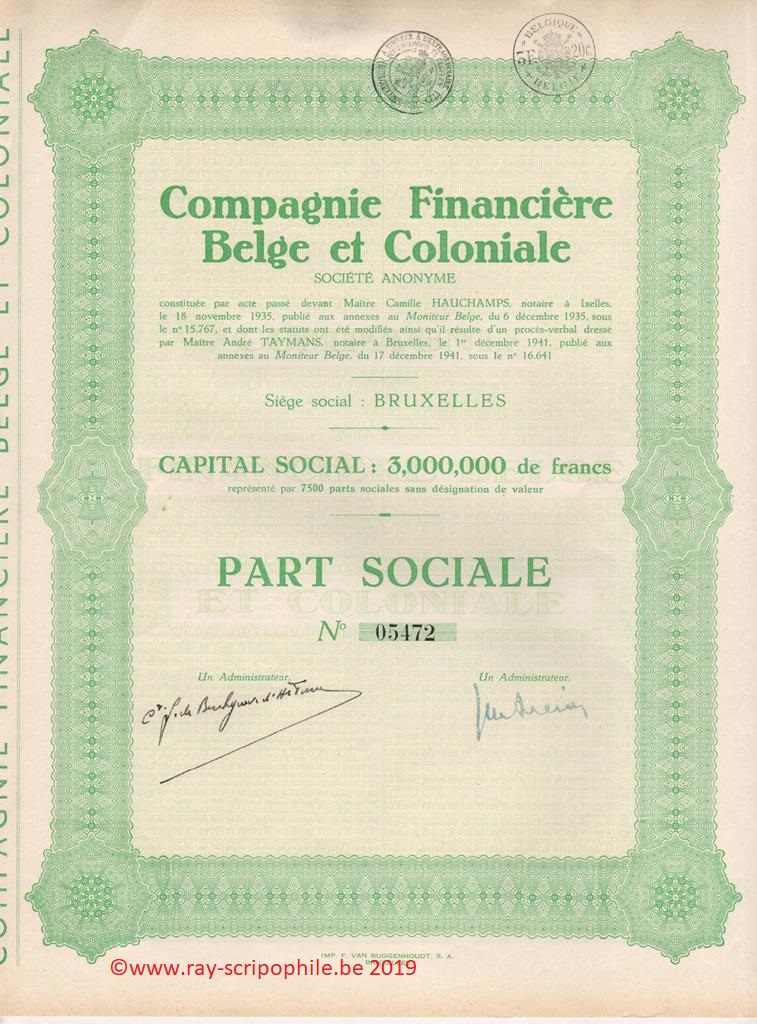

On December 1, 1941, the EGM decided to merge with Banque Belge et Coloniale, which went into liquidation on December 2, 1940 - See Banque Belge et Coloniale .

.

Following this merger, Compagnie Financière Belge et Coloniale decided to increase its capital by 1,500,000 francs by the creation of 3,750 new shares as remuneration for the contribution made by Banque Belge et Coloniale.

The new shares were distributed to the holders of shares in Banque Belge et Coloniale based on one share in Compagnie Financière Belge et Coloniale for every four shares in Banque Belge et Coloniale (12-(17/12/1941)-16641).

On March 18, 1954, Compagnie Financière Belge et Coloniale became the owner of 500 shares of S.A. Comptoir d'Applications Techniques et Thermiques in Brussels, this company was dissolved by right, the liquidation carried out by Compagnie Financière Belge et Coloniale was definitively closed (12-(05-06/04/1954)-6309).

On January 24, 1983, the EGM modified its corporate purpose and adopted the new name "Unicomin" Union du Commerce et de l'Industrie (still in operation in 2013).