BANQUE BELGE ET COLONIALE S.A.

Constitution

This Company was incorporated on May 19, 1926 under the name Maison Bruneel et Dhanis, Société Anonyme de Banque et de Gestion in Brussels; its registered office was established in Brussels.

The capital of 750,000 francs was represented by 1,500 capital shares of 500 francs and 2,000 dividend shares without designation of value.

The capital of BEF 750,000, 60% paid up, was subscribed in cash as follows:

Messrs. Léopold baron Dhanis, 690 shares; Francis baron Dhanis, 670 shares; Jules-Alfred comte Ancion, 60 shares; Gustaves Bruneel, 40 shares; Albert Bruneel, 18 shares; Jean-Baptiste Nys, 20 shares; Maurice Pauwels, 2 shares.

In consideration for the contributions below, Messrs. Bruneel and Mr. Dhanis were granted 1,700 dividend shares, which they distributed in accordance with their specific agreements. The remaining 300 dividend shares were distributed among the subscribers based on one dividend share for every five shares subscribed.

Contribution(s)

Messrs. Bruneel and Mr. Dhanis contributed to this Company the bank house they operated under the name Comptoir Financier in Brussels. This contribution included:

The business, the firm, the clientele of the said establishment, its organization, documentation and archives as well as the lease of the premises.

The furniture furnishing the offices and premises, according to an inventory that all the comparators declared to be known and approved.

Their professional knowledge and business relations.

The benefit of agreements and contracts concluded with third parties for the proper conduct of business.

The leasing and competition of the newspaper published by Messrs. Bruneel and Mr. Dhanis, under the title of Revue de la Bourse et de l'Industrie.

First Board of Directors

The number of directors was set for the first time at 5 members: Messrs. Francis Baron Dhanis, Léopold Baron Dhanis, Gustave Bruneel, Georges Grenade and Jules Alfred Comte Ancion (12-(06/06/1926)-7295).

Object

The purpose of the Company was, both for itself and on behalf of third parties, in Belgium or abroad, all financial, real estate, banking, exchange, brokerage or commission transactions.

In particular, it could grant or carry out all discounts, collections, loans or credit openings, with or without real estate or other guarantees, issue cheques or public instruments, manage all property or securities, buy, sell, exchange all securities or securities, accept securities, securities or funds on deposit, with or without interest; take all shareholdings or financial interventions, take care of the study, creation, acquisition and operation of any commercial, industrial, financial or other business.

The Company could also grant and contract any loans in the form of the issue of bonds, savings bonds, credit facilities with or without real guarantees or other The Company could therefore carry out any operations or negotiations involving movable or immovable property or take a direct or indirect interest in them, either for itself or on behalf of third parties. The Company absolutely prohibited itself from any purely speculative operation or transaction (12-(06/06/1926)-7295).

Modification, transformation of capital, change of name

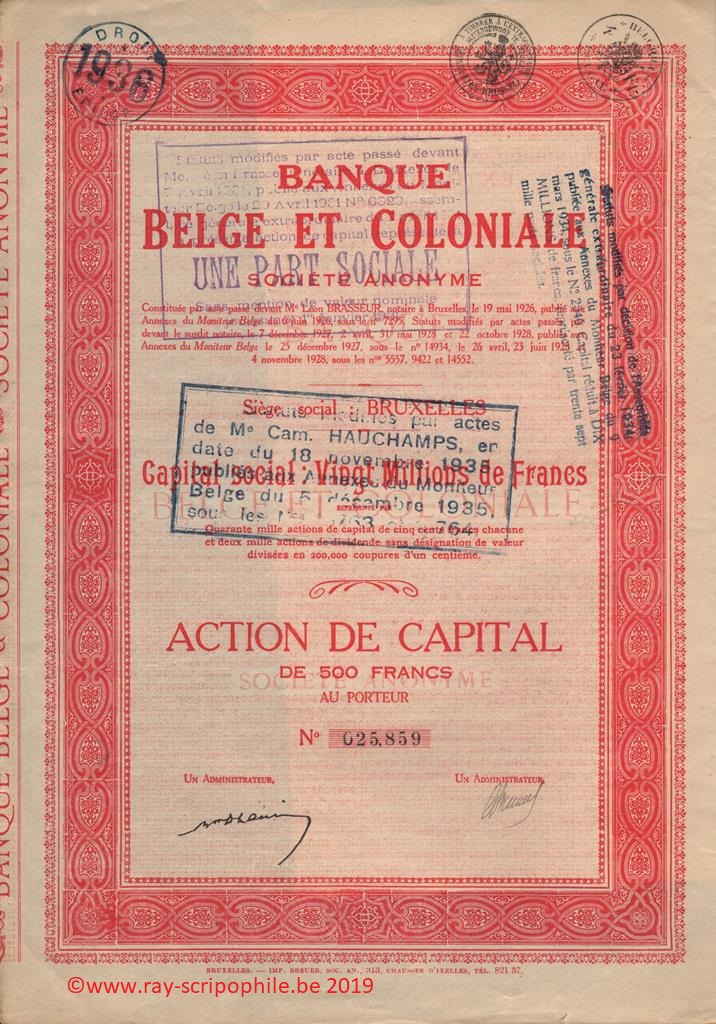

On September 7, 1927, the EGM decided to increase the capital by 1,250,000 francs by creating 2,500 shares with a capital of 500 francs, the latter were subscribed by 11 participants at the price of 500 and paid up by 20% (12-(25/12/1927)-14933).

On May 31, 1928, the EGM decided on a new capital increase of 3 million francs through the creation of 6,000 shares with a capital of 500 francs, which were subscribed by 25 participants at a price of 750 francs. The shares were paid up at different rates. The same meeting changed the company's name to S.A. Banque Belge et Coloniale (12-(23/06/1928)-9122).

On October 22, 1928, the EGM decided:

1) To divide the 20,000 tenths of dividend shares into 200,000 hundredths of dividend shares.

2) To increase the capital by 15 million francs through the creation and issue of 30,000 new shares of 500 francs each. The issue took place at a price of BEF 800 per new share, with the option to subscribe to one hundredth of a dividend share for each share of new capital subscribed, at a price of BEF 100 per hundredth. These new shares were subscribed by a syndicate whose members were Charles Merckens de Moerkerke and Tom Brown. This syndicate undertook to retrocede the new shares by him to the former shareholders who so requested in the proportion of one share of new capital for one old share or for 100 hundredths of dividend shares (12-(04/11/1928)-14552).

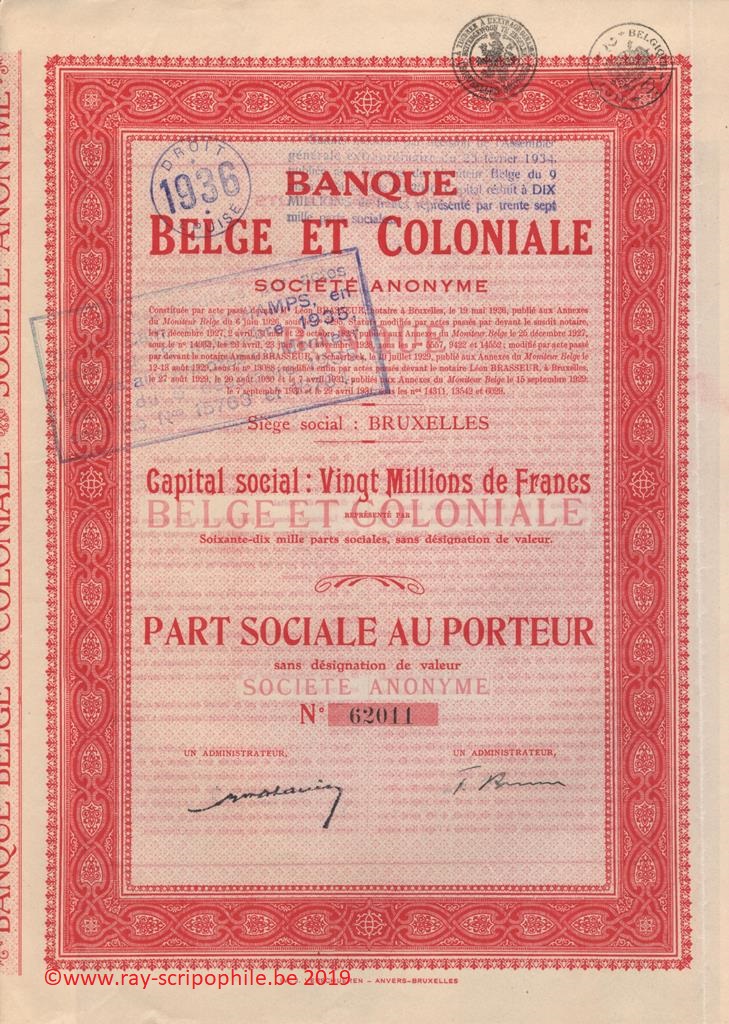

On April 7, 1931, the EGM decided to abolish the two existing classes of shares and to replace them with 70,000 shares without designation of value. These new shares were allocated at the rate of one share for each capital share and three shares for every twenty hundredth dividend share (12-(29/04/1931)-6029).

On February 23, 1934, the meeting decided to reduce the capital to 10 million francs. This capital reduction was carried out as follows:

By destroying the 30,000 shares* and reducing the capital by 9,428,571.43 francs, the difference of 571,428.57 francs was made up by a depreciation (12-(09/03/1934)-2045).

On November 18, 1935, the EGM decided to comply with the provisions of the Royal Decree of 9 July 1935 on the control of banks and the regime for the issue of securities and securities and to retain the activity of deposit bank.

The meeting also authorized the contribution to a public limited company to be set up under the name of Compagnie Financière Belge et Coloniale of all the shareholders' shares and holdings making up the bank's portfolio, in return for the allocation of 3,750 shares without designation of value the new Company.

The new Company "Compagnie Financière Belge et Coloniale" was set up with a capital of 1,500,000 francs represented by 3,750 shares without designation of value.

The Banque Belge et Coloniale contributed to the new company its entire portfolio, including colonial securities: shares of the Comité National du Kivu; shares of the Société Auxiliaire Agricole du Kivu; shares of the capital and founder's shares of the Société Minière de l'Afrique Centrale; and a tenth of a share of the founder's Société de Recherches Minières au Katanga.

As remuneration for its entire portfolio, it was allocated to Banque Belge et Coloniale 3,700 fully paid-up shares of Compagnie Financière Belge et Coloniale. The remaining 50 shares were subscribed for cash at a price of 400 francs per share - See Compagnie Financière Belge et Coloniale.

As a result of the change in its activity, its corporate purpose was modified as follows:

The object of the Company was, both for itself and on behalf of third parties, in Belgium or abroad, all banking, discounting, rediscounting and related operations, including the rental of safes, the transfer and insurance of funds and securities, and stock exchange operations. It could carry out any undertaking or transaction directly or indirectly related to its object or likely to further its object, except for transactions prohibited to deposit banks (12-(05/12/1935)-15763).

Dissolution, liquidation, merger, closure

On December 2, 1940, as a result of the events, part of the Bank's assets was abroad in conditions that did not allow for their return before the end of hostilities. As a result, the Bank was in a difficult financial situation, particularly in view of the lack of cash on hand, the Bank decided to dissolve the company early and declare it in liquidation (12-(18/12/1940)-12622).

On December 1, 1941, the EGM decided to merge Banque Belge et Coloniale in liquidation with the S.A. Compagnie Financière Belge et Coloniale, which had been created six years earlier. The exchange was carried out based on one share of Compagnie Financière Belge et Coloniale for four shares of Banque Belge et Coloniale in liquidation (12-(17/12/1941)-16640). On the same day, the liquidation was closed (12-(17/12/1941)-16642).

*Prior to this, a deed drawn up by Notary Salentiny in Ettelbrück (Grand Duchy of Luxembourg) on January 3, 1934 established that the Banque Belge et Coloniale had become the owner of all the shares of the S.A. Société Financière d'Entreprises Internationales (Fininter), holding company, having its registered office in Luxembourg.

Banque Belge et Coloniale thus became the sole owner of all the assets of the Société Financière d'Entreprises Internationales (Fininter), including the 30,000 shares of Banque Belge et Coloniale.