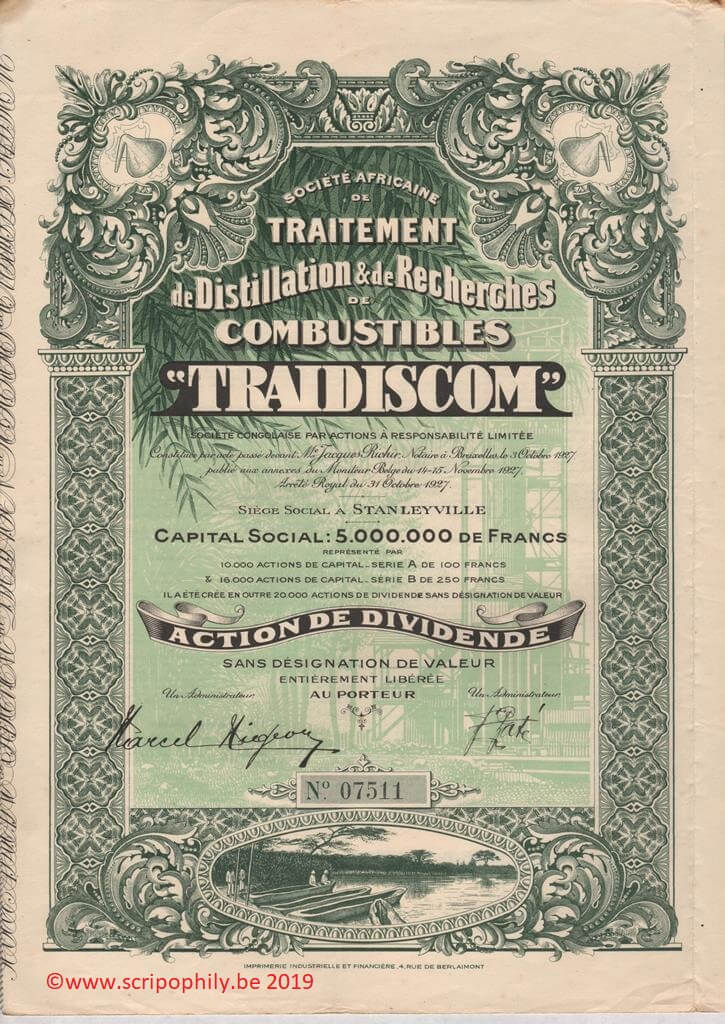

Société Africaine de Traitement de Distillation & de Recherches de Combustibles - TRAIDISCOM - S.C.A.R.L.

Constitution

The S.C.A.R.L. Société Africaine de Traitement, de Distillation et de Recherches de Combustibles "TRAIDISCOM" was incorporated on October 3, 1927.

The share capital was fixed at 5 million francs represented by 10,000 shares of capital series A, with a nominal value of 100 francs and 16,000 shares of capital series B, with a nominal value of 250 francs.

The registered office was established in Stanleyville and the administrative office in Brussels.

It was created, moreover, 20,000 shares of dividend without designation of value, which could neither be cancelled, nor reduced by decision of the general assembly of the shareholders even deliberating as a matter of modifications to the statutes.

New dividend shares could only be created in the future at the rate of 1,000 shares per million of new capital.

Subscriptions:

The 10,000 capital shares, series A, were subscribed by Messrs. Albert and Raymond Hottat, Marcel Migeon and Paul Colin acting both for themselves and for the limited company "'Traitement et Distillation de Combustibles Pauvres (Procédés Marcel Migeon).

The 16,000 shares of capital of 250 francs, series B, were subscribed as follows:

Mr. Albert Hottat, both for himself and for a group, 1,000 shares; Mr. Raymond Hottat, both for himself and for a group, 1,000 shares; Mr. Joseph Muyle, both for himself and for a group, 2,000 shares; Mr. François Paté, both for himself and for a group, 2. 460 shares; Mr. Henri Pays, both for himself and for a group, 2,000 shares; S.C.R.L. Caéfa, Compagnie Africaine d'Exploitations Forestières et Agricoles, 2,000 shares; Mr. Louis Carion, both for himself and for a group, 300 shares; Mr. René Reding, both for himself and for a group, 300 shares; Mr. Joseph Schramme, both for himself and for a group, 2,000 shares; Mr. Léon Jacques Lens, 40 shares; Mr. Ernest Baillieu, both for himself and for a group, 200 shares; Mr. Pierre Hoffmann, both for himself and for a group, 100 shares; Mr. Emile Jenni, as well for himself as for a group, 2,000 shares; S.A. La Foncière Immobilière Nationale, 200 shares; S.C.R.L. La Foncière Immobilière Coloniale " Fonico ", 200 shares; S.C.R.L. " Katanga-Kivu ", colonization company, 200 shares.

All the subscribed A and B shares were paid up to 20%, that is to say the sum of one million francs put at the disposal of the Company (30-1927)-(1093 à 1110).

Contribution(s)

Migeon, authorized by the limited company "Traitement et Distillation de Combustibles Pauvres (Procédés Marcel MigeonThe process consists in carbonizing oil seeds with the production of crude oil, coke and gas; the carbonization oil is then fractionated to extract the water, isolate the carbon and the pitch.)", because of his interest in the present company, as the latter company, duly represented, recognized, declared that he was making a contribution to the presently constituted company, which was accepted by all the parties present: of its studies on the carbonization of wood in the Belgian Congo, of the complete plans of wood carbonization plants with all the production and rectification equipment of the by-products; of the benefit of its markets and contracts for the eventual supply of the said plant, of the benefit of its arrangements for its installation in Africa and the supply of wood waste to the plant; a set of commitments ensuring the technical management and the guarantee of the industrial output of a plant, in by-products, his studies and steps to ensure the sale of by-products; his steps to ensure the present company the exclusive right of representation in the Belgian Congo and the right of preference, for Africa except Morocco, of the exploitation of distillation processes, known under the name of "Marcel Migeon Processes" as well as of all subsequent improvements

Mr. Migeon also contributed the benefits to be derived from his applications to the Government of the Colony for the importation of his special equipment into the Belgian Congo and for the right to search for oil shale north of the fifth parallel south and the right to exploit it later, as well as the benefits to be derived from his application for a forest concession in the Belgian Congo.

In remuneration of the above contributions, the 20,000 dividend shares were attributed to Mr. Migeon, who expressly declared that he would accept them in return for the contributions he had to make (30-1927)-(1093 to 1110).

First Boardof Director

Fixed for the first time at seven directors:

Messrs. Joseph Muyle, Raymond Hottat, Albert Hottat, Marcel Migeon, François Paté, Henri Fays, Lucien Beissel.

Fixed for the first time at five commissioners:

Messrs. Louis Carion, Paul Colin, Joseph Schramme, René Reding, Ernest Baillieu (30-(1927)-(1093 à 1110).

Object

To search in Africa for forests, carboniferous and bituminous shale deposits, to create and operate fuel distillation plants, to process and trade the by-products. To be able to carry out all commercial, industrial, real estate or financial operations in order to achieve its corporate purpose in Africa and especially in the Belgian Congo.

To be able to take an interest by way of transfer, contribution, subscription, financial participation or in any other way, in all companies or enterprises whose object would be directly or indirectly related to its corporate object or which would be likely to promote or develop its corporate activity. It May merge with them (30-(1927)-(1093 à 1110).

Change of capital, event(s), participation(s)

1928 - The installation of the first plant was underway. The complete equipment for the plant, which will be erected in Utisongo, on the river downstream from Stanley City, was ready and partly shipped.

Following the extension of its industrial production program in Africa, which entailed new material expenses, the increase in the cost of freight and transportation by rail and water in the Congo, and especially the forthcoming organization of mining research missions for carboniferous materials in order to prospect a concession granted to Mr. Migeon by the government of the Colony, it was identified that an increase in capital became essential to meet future needs.

Consequently, the assembly proposed to increase the capital from 5 to 10 million francs by the creation of 10,000 capital shares series A of 100 francs and 16,000 capital shares series B of 250 francs, which will enjoy the same rights and advantages as the existing shares of the same category subscribed in cash. The Board was entrusted with the realization of this capital increase (21-(1928 T3)-1305).

1929 - The extraordinary meeting of March 25 decided that there was no need to follow up on the proposal made at the last meeting and decided to increase the capital by 2,500,000 francs to 7,500,000 francs by creating 10,000 new capital shares of 250 francs, series B, with dividend rights as of January 1, 1929, issued for cash and at par, without subscription rights for former shareholders. The 10,000 shares were subscribed by: the Mutuelle Mobilière et Immobilière Coloniale (Mico), 4,000 shares ; Genaplan (Société Générale Belge de Plantations), 4,000 shares ; the Société Traitement et Distillation de Combustibles pauvres (Marcel Migeon procédés), 2,000 shares.

The same meeting gave the Board full powers to increase the capital from 7,500,000 francs to 10 million francs, in one or more instalments, by creating 10,000 new series B capital shares, of the same type as those already in existence, without any preferential right for the existing shares.

The Board of Directors authorized, among other things, to grant an option until March 1, 1930 for the subscription in cash of these shares.

The meeting also decided to create new dividend shares within the limits fixed by the articles of association, i.e. 2,500 relating to the capital increase of 2,500,000 francs carried out, and 2,500 which will relate to the increase of 2,500,000 francs provided for above and which will be allocated to future new subscribers. The meeting decided to limit definitively to 25,000 the number of dividend shares, a number which cannot be increased any more, even by way of modification of the statutes.

The capital shares of series A, even if fully paid up, remain registered until the approval by the general meeting of shareholders of the second balance sheet. During this period, these shares could only be sold to persons approved by the Board of Directors. After this period, the Series A shares will be bearer shares provided they are fully paid up; the Series B shares are bearer shares provided they are fully paid up; the dividend shares were issued to bearer.

The plant built in Utisongo, near Stanleyville, went into operation at the beginning of 1930 (21-(1931 T3)-892/93).

Merger ?

The extraordinary assembly of February 28, 1930 had decided to operate the merger with the Société Commerciale et Industrielle Africaine (Socomina) by way of contribution of all the assets and liabilities of the Company.

This merger was to take place under the following conditions:

The Socomina Company after having increased its capital from 1 million to 13.500.000 francs, was to give to Traidiscom (in exchange of 10.000 capital A and 26.000 capital B), 15.000 shares of 500 nominal francs out of the 27.000 existing shares.

This exchange was to be done at the rate of 5 capital A against 1 Socomina share and of 2 capital B against 1 Socomina share.

The 22,500 dividend shares of the Traidiscom Company were to be exchanged for 3,000 founder's shares of the Socomina out of the 7,500 existing founder's shares. 15 dividend shares of Traidiscom were to be exchanged for 2 founder shares of Socomina.

The above resolutions were to become final only on the day when Socomina would have regularly and definitively accepted the proposals voted above and that the modifications it had to make to its articles of association would have been regularly approved by royal decree, this decree having to intervene before June 30th 1930. It seems that these conditions have not been fulfilled (21-(1931 T3)-892/93)

According to the publication in the Moniteur Belge of 28 May 1932, there is no mention of a company in liquidation.

He also mentions in the Recueil Financier of 1935 and 1936 that the subsidiaries, the Traidiscom Company and the Caéfa Company, were both declared bankrupt (21-(1935 T1)-190) (21-(1936 T1)-630)

Nothing more thereafter