COMINEX - COMPAGNIE CONGOLAISE D'IMPORTATION ET D'EXPORTATION - S.C.R.L.

Constitution

It was on the initiative of the Compagnie Générale du Congo that COMINEX ''Compagnie Congolaise d'Importation et d'Exportation'' was set up on 15 December 1922 with a capital of 8.5 million francs represented by 17,000 shares of five hundred francs; of these 17,000 shares, 13,000 were allocated to the Compagnie Générale du Congo as remuneration for the contributions described below. The following parties subscribed the remaining 4,000 shares:

Société anonyme Bunge, 2,200 shares; La Commerciale Anversoise du Congo, 800 shares; Société anonyme de Gérance et de Placements financiers, 275 shares; Banque Centrale Anversoise, 400 shares; Société des Usines Cotonnières Gand-Zele-Tubize, 50 shares; Société en nom collectif " Ch. Lejeune", 50 shares; Société des Anciens Etablissements Diomède Vanderhaeghen, 50 shares; Mr. Jean-Frédéric Speth, 50 shares; Mr. Pierre Marquis de Beaucorps, 50 shares; Mr. Herman-William Marsily, 50 shares; Mr. Joseph Muylle, 25 shares.

The subscribed shares were fully paid up and the sum of two million was at the disposal of the new company.

The head office was established in Kinshasa and the administrative office in Brussels

Contribution(s)

The Compagnie Générale du Congo contributed several properties located in Kinshasa, Basankusu, Coquilhatville, Buta and Titulé, as well as movable property in the Belgian Congo, river equipment, goods that the Compagnie Générale du Congo owned in Africa and the commercial organization of the Compagnie Générale du Congo.

First Board of Directors

Directors

Mr. Marcel Berré, Mr. Pierre Clynans, Mr. Désiré De Schoonen, Mr. Franz Dupont, Mr. Willy Friling, Mr. Herman-William Marsily, Mr. Alexis Mois, Mr. Jules Renkin, Mr. Jean-Frédéric Speth, Mr. Paul Van den Ven.

Commissioners

Pierre Marquis de Beaucorps, Joseph Muylle, Clément Swolfs.

Object

All commercial, industrial, agricultural, real estate, financial and maritime operations, within the widest limits, in Africa and especially in the Belgian Congo. To be able to conduct the same operations in all countries as a preparation for or because of operations conducted in Africa, or when they have some other connection with them. To be able to take an interest by way of transfer, contribution, subscription, financial participation, loan, or any other means, in all companies or enterprises whose corporate purpose, or which were of a nature to promote or develop its corporate activity; to be able to merge with them (30 - (1923) - 86 to 104).

Changes in capital, event(s), shareholding(s), dividend(s), listing, etc.

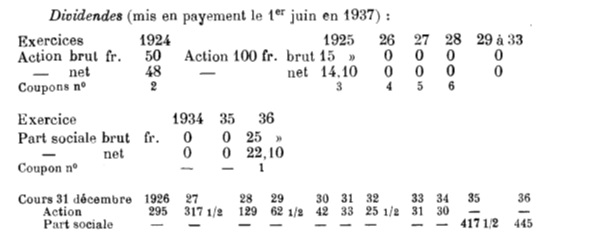

The first financial year justified the forecasts made at the time of the Company's incorporation. Having taken over from the Compagnie Générale du Congo, the new company was able to devote itself to developing its business. Its installations in interesting regions enabled it to achieve considerable sales figures for the year 1923.

In addition to import and export operations, the company took on the Indigenous food trade, which was to become important due to the ever-increasing use of local labor (21- (1925 T2) - 791).

On 9 November 1925, the 17,000 shares of five hundred francs were transformed into 85,000 shares of one hundred francs. Subsequently, the capital was increased to twenty-five million francs by the creation of 165,000 new shares of one hundred francs, with entitlement to dividends on 1 January 1926, which were subscribed to at par by Crédit Général du Congo; 92,000 shares were put up for sale by public subscription from 16 to 28 December 1925, at a price of 130 francs (21 - (1927 T1) - 599).

In 1927, the Company sold its Uélé and Equateur sections to the Société Commerciale et Agricole de l'Uélé ''Socouélé'' and the Société de l'Equateur pour le Commerce, l'Industrie et l'Agriculture ''Secia'' respectively. It also transferred the operation of its Mayumbe counter to the Société des Plantations du Mayumbe ''Soplama'', its Bas-Congo counter to Alberta, and its Stanleyville section to the Compagnie de l'Est Africain Belge. Thanks to arrangements it made with the groups subscribing to the Socouélé and Secia capital, Cominex shareholders were able to subscribe to shares in these companies (21 - (1929 T1) - 639/40).

As the complete realization of this new program required substantial resources, the capital was increased on 16 December 1927 from 25 to 50 million francs by the creation of 250,000 shares of one hundred francs, with dividend rights from 1 January 1928, which were subscribed to at the price of 140 francs by the Crédit Général du Congo. The former shareholders were able to subscribe, at a price of 165 francs per share, on an irreducible basis, to four new shares for every five old shares* and on a reducible basis to the balance that might be available (21 - (1929 T1) - 639).

During the first years of its existence, the Company conducted commercial activities in various regions of the Congo. Unfortunately, from 1928 onwards, because of the crisis, the Company was forced to gradually cease its commercial activity (21 - (1937 T2) - 1014).

From 1928 to 1933, the Company had to deal with the crisis in the Congo; these budget years were loss-making, resulting in a loss of twenty-five million francs at the end of 1933.

The Assembly of 16 October 1934 decided not to dissolve the Company and proceeded to modify the capital and accepted the proposal of the Crédit Général du Congo; details below:

Reduction of the capital by twenty-five million to bring it down to twenty-five million; this reduction was allocated to necessary depreciation and to the amortization of losses as of 31 December 1933. The Company then decided to transform the 500,000 shares of one hundred francs into 50,000 shares of no-par value, the securities were exchanged in the proportion of one share for ten shares of one hundred francs.

Acceptance of the contribution made by Crédit Général du Congo of 500 series A shares of five hundred francs and 3,800 series B shares of five hundred francs of the Congolese company SYMAF (Syndicat Minier Africain) and the creation of 20,000 fully paid-up Cominex shares which were handed over to Crédit Général du Congo as remuneration for the contribution. These shares had the same rights as the 50,000 newly issued shares (21 - (1935 T1) - 55/56).

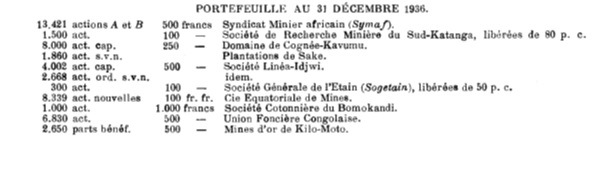

Following the financial reorganization, the Company was in favorable conditions. In addition to the funds invested in the portfolio and the financial participations, the Company had cash at its disposal. Amongst others, it had holdings in the companies SYMAF ''Syndicat Minier Africain'', which was devoted to the management of its operating subsidiaries Symétain and Symor, Société de Recherche Minière du Sud-Katanga, the coffee plantations Domaine de Cognée-Kavumu, Société Linéa-Idkwi and Plantations de Lukayo-Sake (21 - (1936 T3) - 88/89).

In 1935, the Company participated in the constitution of the Union Foncière Congolaise with a capital of fifteen million francs represented by 30,000 shares of five hundred francs, of which 6,830 shares were attributed to Cominex in remuneration for the contribution of its real estate assets in the Belgian Congo. Cominex also had interest in the Compagnie Cotonnière du Bomokandi and the Société Générale de l'Etain ''Sogétain''. The Company also took an interest in the Compagnie Equatoriale de Mines (21 - (1937 T2) - 1015/16).

For 1936, the economic activity of the Colony and the maintenance of remunerative prices for the main raw materials influenced the results of the companies in which Cominex held shares. The dividends received in 1936 were significantly higher than in 1935 (21 - (1937 T2) - 1015/16).

(21 - (1937 T2) - 1015/16)

Merger

On 22 November 1937, the Company merged with Crédit Général du Congo ''Crégéco''. Cominex contributed all the assets existing on 31 December 1936. For this contribution, Cominex received 50,000 Crégéco shares to be distributed among the shareholders based on one capital share for one Cominex share; the 20,000 Cominex shares held by Crégéco were cancelled (21 - (1938 T2) - 394).