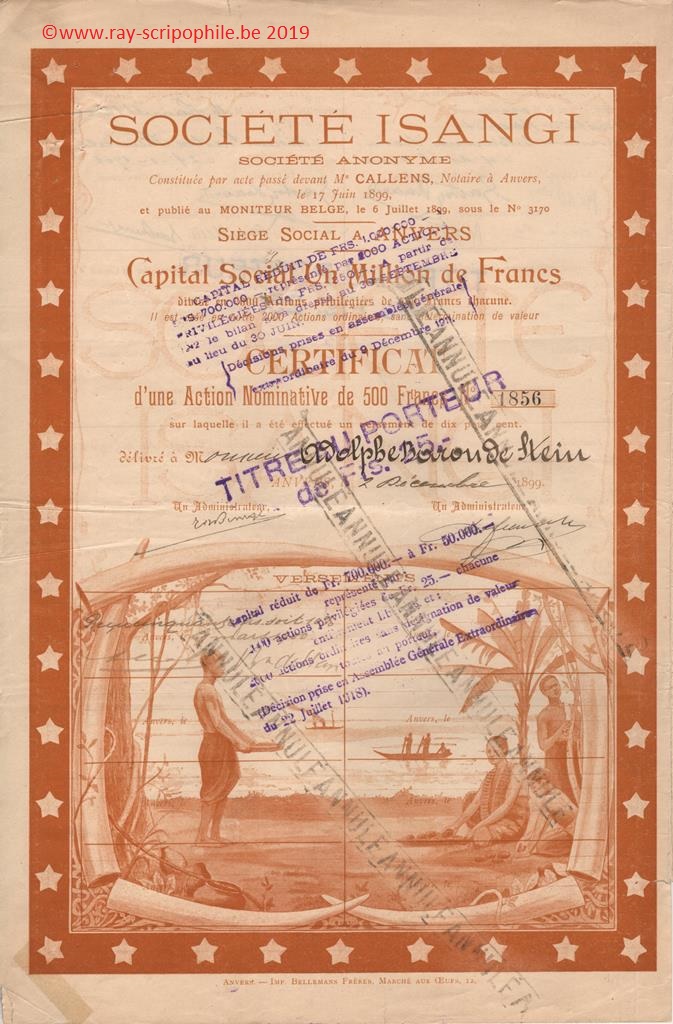

SOCIETE ISANGI S.A.

Constitution

The Isangi Company was incorporated on June 17, 1899 with a capital of one million francs divided into 2,000 preferred shares of 500 francs each; in addition, 2,000 ordinary shares without designation of value were created. The registered office was established in Antwerp

Capital subscription

Of the 2,000 preference shares, 1,200 shares were allocated as consideration for the contribution described below, the remaining 800 shares were subscribed for by:

Contribution(s)

First Board of Directors

For the first time the Board of Directors was set at 6 members:

Object

Changes in capital, event(s), shareholding(s), dividend(s), quotation, etc.

From July 1904 until the end of 1926, the Isangi estate was exploited by the company ABIR in return for a royalty of 5% of all ABIR's income. In addition to this fee, ABIR paid 22 annual instalments of 13,000 francs for the use of the buildings (21-(1912 T1) -1482/83).

In 1911, following the merger of ABIR and Antwerp, the Isangi Company received 1,000 shares out of the 17,000 shares representing the capital of the Compagnie du Congo Belge. The Isangi Company also received a sum of 143,000 francs for discounting the annual instalments of 13,000 francs owed to it by ABIR.

From then on, the activity of the Isangi Company was limited to the management of its portfolio.

On 9 December of the same year, the capital was reduced to 700,000 francs by reducing the nominal value of the 800 preference shares originally subscribed for cash, and by reimbursing 150 francs to the 1,200 fully paid-up preference shares belonging to the Société d'Agriculture et de Plantations au Congo. The nominal value of the preference shares was reduced to 350 francs.

On 22 July 1918, the Isangi Company decided to reduce the capital to 200,000 francs by giving 500 shares of the Compagnie du Congo Belge to the 1,200 fully paid-up preference shares held by the Société d'Agriculture et de Plantations au Congo, the nominal value of the shares was reduced to 100 francs; on the same day the capital was reduced to 50,000 francs by distributing the remaining 500 shares of the Compagnie du Congo Belge to the 2,000 preference shares, the distribution was made on the basis of one Compagnie du Congo Belge share for every 4 preference shares. The nominal value of the preference shares, after this last distribution, was fixed at 25 francs (21-(1920 T1) -1380).

In 1926, the Isangi Company, concerned about the end of the concession, considered that it was more interesting to negotiate the transfer of this property (21-(1927 T1) -1080). In the same year, the concession of the Isangi Company was transferred to the Compagnie du Lomami et du Lualaba (21-(1930 T2) -1228).

Dividends

Exercices clos en Actions priv.FB Actions ord.FB | 1900 55 30 | 1901 25 0 | 1902 40 15 | 1903 50 25 | 1904 50 25 | 1905 37,50 12,50 | 1906 à 09 0 0 | 1910 5 0 |