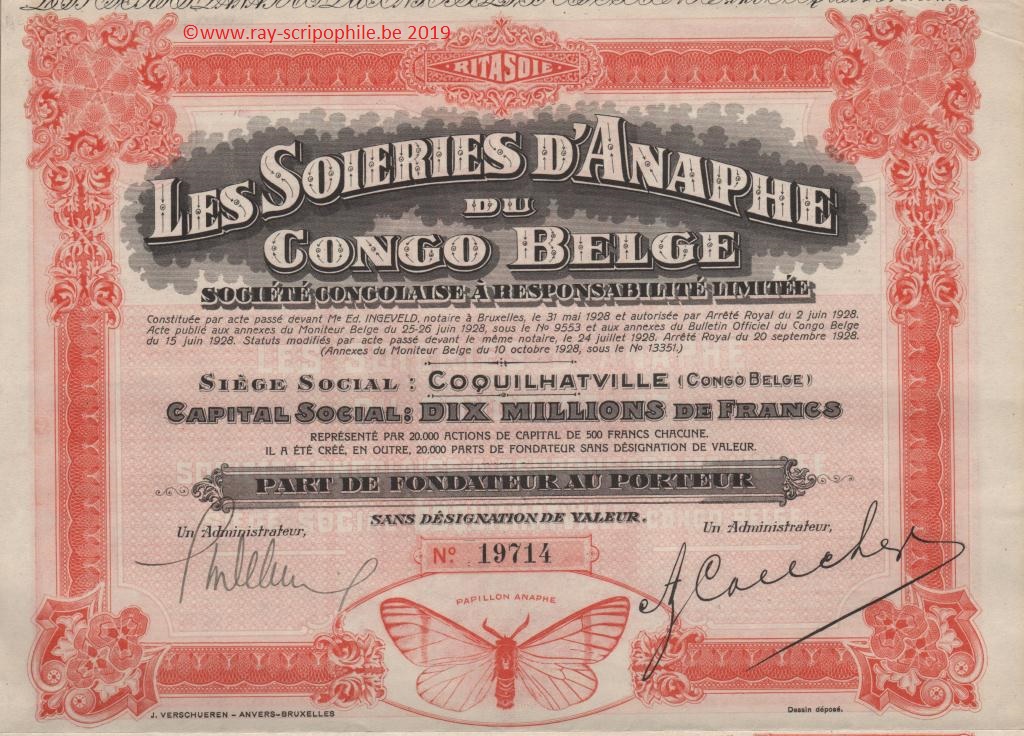

LES SOIERIES D'ANAPHE DU CONGO BELGE S.C.R.L.

Constitution

The Soieries d'Anaphe du Congo Belge was incorporated on May 31, 1928 with a capital of 7 million francs represented by 14,000 shares with a capital of 500 francs; in addition, 20,000 founder's shares were created. The registered office was established in Coquilhatville and the administrative headquarters in Brussels.

The 14,000 capital shares were subscribed by:

Messrs. Alphonse Baron Jacques de Dixmude, 20 shares; Major Auguste Couche for himself and a group, 1,370 shares; Octave Chalon for himself and a group, 2,000 shares; Alphonse Louvet for himself and a group, 1,100 shares; Armand Delens for himself and a group, 1. 800 shares; Léon De Wolf, 20 shares; Iwan Fassin, 500 shares; Jules-François Jacques, 110 shares; Léon-Henri-Joseph Jacques, 400 shares; Alexandre Horlaint for himself and a group, 3,000 shares; Raymond Veyt, 500 shares; S.C.R.L. Société Générale d'Entreprises Commerciales et Agricoles en Afrique "Sogéaf", 2,580 shares; S.A. Les Tissages de Gand, 600 shares.

The shares were paid up by 20% and the sum of 1,400,000 was remitted to the Company.

Of the 20,000 founder's shares, 15,333 shares were distributed to the contributors described below; the remaining 4,667 shares were allocated to the subscribers based on one founder's share for every three capital shares.

Contribution(s)

Mr. Léon De Wolf and Mr. Auguste have contributed to the company:

First Board of Directors

The first board of directors was set at nine people:

Octave Chalon, Major Auguste Couche, Armand Delens, Léon De Wolf, Alphonse Louvet, Alexandre Horlaint, Henri Hamon, Arthur Soupart, Ch. Aug. Belaygue (21-(1929 T3)-727).

Object

Event(s)

1929 - The exercise was devoted exclusively to studies and prospecting. The mission sent to Africa in September 1928 proceeded to study the regions of the province of Ecuador, where the Society's activity was to be carried out. Its surveyed land suitable for the establishment of bridelia (plant) plantations and, consequently, for the rearing of anaphe caterpillars, in the Bangalas region, in the Upper Tshuapa and in the Lulonga-Ikelemba district. All the elements collected made it possible to pinpoint the exact location of the problem of wild silk nest harvesting in Belgian Congo. The findings in this field are not very encouraging.

In spite of all that was said and all that was written, wild silk harvesting in Africa had to be abandoned in the present state of affairs because, although there was in fact an enormous quantity of anaphe nests in the Belgian Congo, these nests were so widely scattered that it was practically impossible to organize the harvest there, unless one paid the natives and the necessary intermediaries a price which the value of the material could not bear.

Bridelia plantations and anaphe caterpillar breeding centers had to be created from scratch, an expensive and time-consuming task which had an impact on the cost price. The cost price of the raw nests was an important factor in the success of the project, as the anaphe material had to be significantly cheaper than the pellet price of the Bombyx Mori (mulberry silkworm) to remain commercially interesting.

In the pursuit of its program, the Company found itself struggling with difficulties of various kinds: the death of its technical director, Mr. Léon Dewolf; the unsatisfactory results obtained by the bulk scouring recommended by the latter, which called into question the problem of shelling the raw nests; the distance from the cultivation land and the high cost of handling and transport: labor difficulties and the virtual impossibility of preventing the natives from destroying the caterpillars.

Experience has shown that a thorough and experimental study of anaphylactic sericulture, a study which will take several years, should be carried out before committing the substantial capital needed to move to the yield stage.

Moreover, even if the technical difficulties were overcome, the question of cost price could only be resolved with the methodical and effective assistance of the public authorities; some talks had begun.

As a precautionary measure, the Board took the initiative to reduce expenditures within strictly necessary limits and only committed the Corporation if the discussions in question resulted in satisfactory solutions; as the future was uncertain, the Board felt it was its duty to propose the dissolution of the Corporation (21-(1930 T3)-1082).