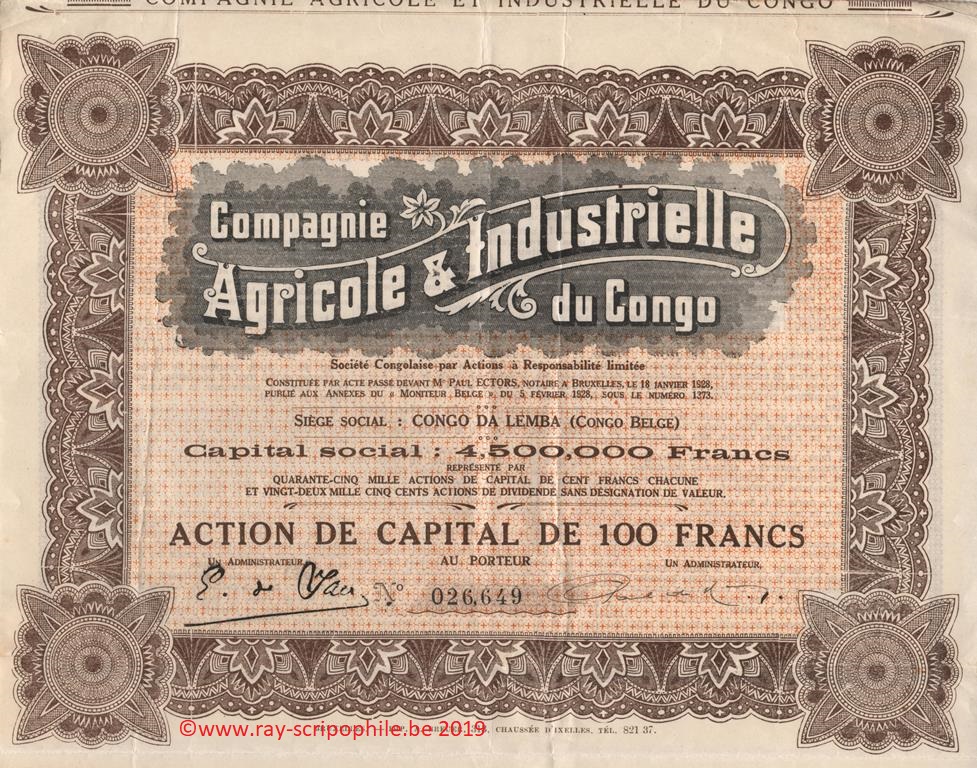

Compagnie Agricole & Industrielle du Congo S.C.A.R.L.

Constitution

This Company was incorporated on January 18, 1928 and had its head office in Congo Da Lemba and its administrative headquarters in Brussels.

Its share capital of 4.5 million francs was represented by 45,000 shares with a capital of 100 francs and 22,500 dividend shares without designation of value.

The 45,000 paid-up capital shares of 20% were subscribed in cash by 7 comparators:

Messrs. Edmond de Jaer, for himself and a group, 34,450 shares; Paul de Man, for himself and a group, 9,530 shares; Robert Jacobs, for himself and a group, 500 shares; Joseph Janssens, 200 shares; Adolphe Delierneux, 150 shares; Jacques Bruneel, 100 shares; Frans Defosse, 70 shares.

The 22,500 dividend shares were allocated to the subscribers of the capital shares, based on one dividend share for two capital shares (12-(05/02/1928)-1373).

First Board of Directors

The first Board of Directors was set at five directors:

Messrs. Edmond de Jaer, Paul de Man, Joseph Janssens, Florent Tanghe, the fifth was not appointed.

Object

The purpose of the Company was the agricultural, industrial and commercial exploitation in the Congo, the creation of crops to produce sisal and other textile materials, cash crops, food crops, and the raising of large and small livestock.

The company could, in addition, acquire any concessions or properties and make any agreements with third parties or other companies already incorporated or to be incorporated.

It could carry out all pastoral, agricultural, forestry, commercial and financial operations, both in Congo and abroad, and operate or take an interest in any transport company (12-(05/02/1928)-1373).

Change(s), transformation(s) of capital

On 20 May 1930, the Board of Directors increased the capital by BEF 1.5 million by creating 15,000 shares with a par value of BEF 100. These 15,000 newly created capital shares were all subscribed by Mr. Robert Jacobs, stockbroker, both for himself and for a group, and each of the shares was paid up to 50%.

The subscriber then undertook to offer the 15,000 shares to existing shareholders within six months at a maximum price of BEF 105 per share, on the basis of one new share for every three old shares as an irreducible entitlement (12-(13/06/1930)-9932).

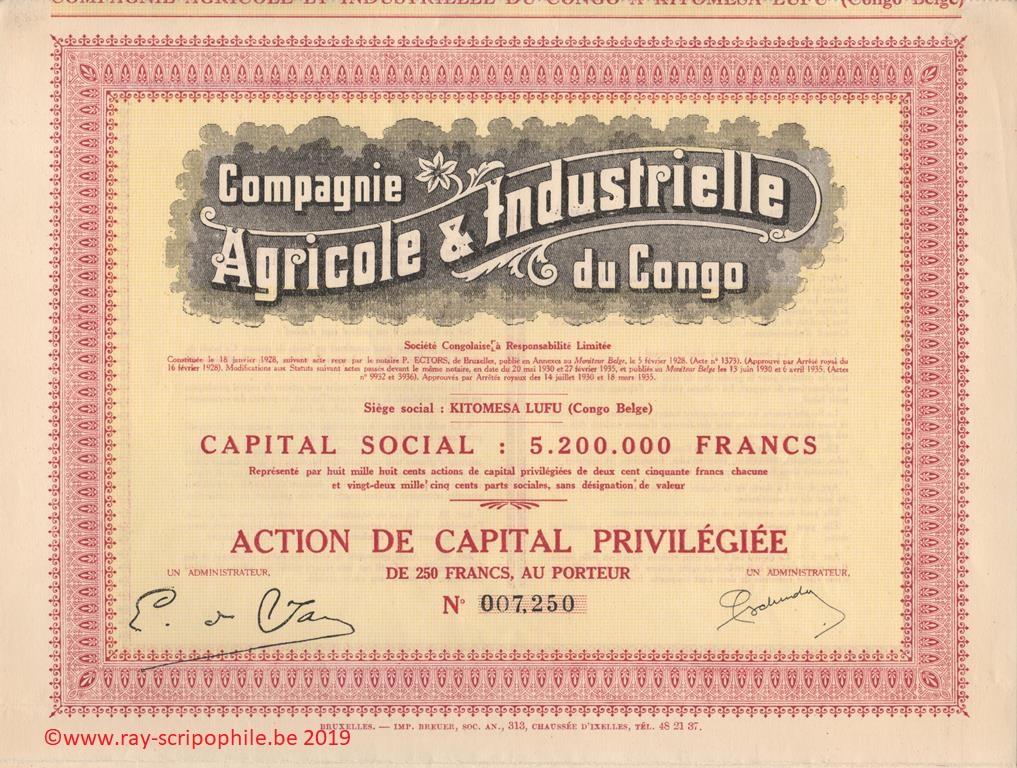

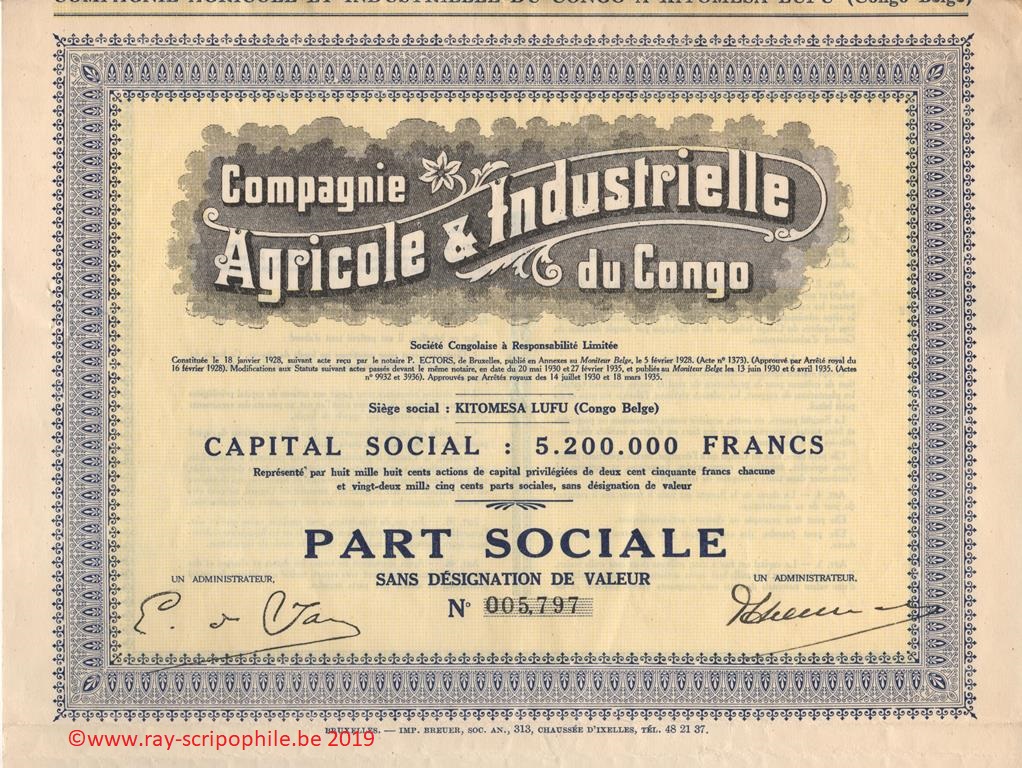

On February 27, 1935, the Meeting decided to reduce the share capital from BEF 6 million to BEF 3 million. This reduction was allocated to depreciation on the account of the first establishment and the profit and loss account. The reduced capital will be represented by the creation of 22,500 shares without designation of value.

The 60,000 capital shares and the 22,500 dividend shares were exchanged based on one company share for four capital shares and one company share for three dividend shares.

The same Meeting decided to increase the capital from BEF 3 million to BEF 5.2 million by creating and issuing 8,800 preference capital shares at par value of BEF 250 each, entitled to an initial dividend of 6% net and to one third of the profits still to be distributed and, in the event of liquidation, to half of the assets to be distributed. The 8,800 new preference capital shares were subscribed for cash, at par value of BEF 250 each, by Mr. Harold Linnenfeld, 20% paid up; the registered office was transferred to Kitomesa Lufu (12-(06/04/1935)-3936).

On July 20, 1937, the EGM decided to increase the capital by BEF 2.525 million to BEF 7.725 million by creating and issuing at par 10,100 new preference shares of BEF 250 each with the same rights and benefits as the old preference shares, and to create and issue 12,500 profit shares not representing capital, having the same rights and benefits provided for in Article thirty-six of the Articles of Association as each of the current 22,500 shares, unless there is a legal restriction on voting.

Mr. Al. Harold-C. Linnenfeld, a company director, residing in Purley (Surrey) England, undertook to underwrite the 10,100 new preference shares and to pay them up at par against, in addition, the allotment in favor of the subscriber of the 12,500 profit shares; the whole against payment of BEF 2.525 million.

The share capital was then 7.725 million represented by 18.900 preferred capital shares of 250 francs each, 22.500 shares without designation of value, all subscribed and fully paid up, and that there are, in addition, 12.500 profit shares (12-(13-14/09/1937)-13047).

Bankruptcy

The company went bankrupt in 1940 (press clipping and information from M. de Jaer's grandson).