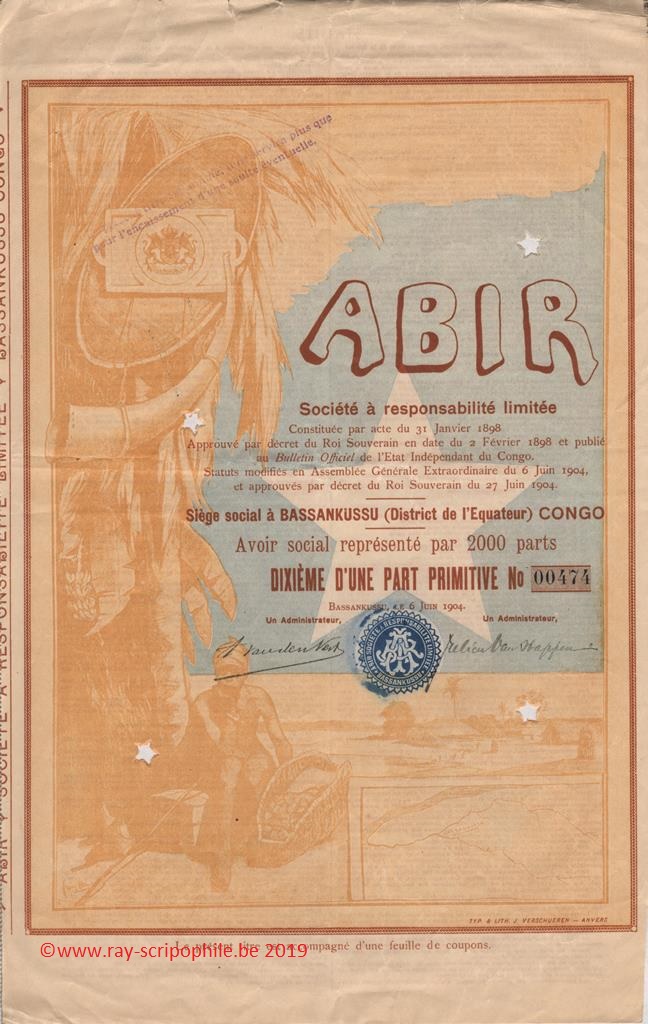

A.B.I.R. - Anglo-Belgian India Rubber and Exploration Cy S.R.L.

Constitution

The A.B.I.R. was incorporated on January 31, 1898 as a S.R.L. following the Belgian company "Anglo-Belgian India Rubber & Exploration Cy" (Société Anonyme) in liquidation set up on August 6, 1892 by John Thomas North also known as Colonel North, the initial capital was 1 million Belgian francs (232,000 Belgian francs paid up). The Company in liquidation contributed all its assets and liabilities to the newly created Company. In remuneration of these contributions, the contributors were allotted every 2,000 shares representing the Company's assets. Each profit-sharing share of the Company in liquidation gave the right to a share divided into tenths in order to make them more accessible to the modest purses (1, 3-134, 25-135 to 137).

The contributors to the new Company were (1) :

Alex de Browne de Tiège acting:

In his name, as owner of 60 shares;

mandatary of the E.I.C., with 1,000 shares;

Comte Horace van der Burch, acting:

In his name, as owner of 58 shares;

mandatary of Mr. A Van den Nest, owner of 125 shares;

Charles de Wael acting:

In his name, as owner of 6 shares;

As mandatary of Mrs Alexis Mols, Alfred Osterrieth, Maurice Ortmans, Thys et Vanderlinden, Ernest Vanderlinden, Henri Vanderlinden, owners of 75 shares;

Jules Stappers, owner of 5 shares;

Frédéric Reiss, owner of 3 shares;

Alphonse Lambrechts, owner of 40 shares;

Constant de Browne de Tiège, owner of 50 shares;

Bunge et Cie, owner of 50 shares;

W Mallinckrodt, owner of 45 shares;

M Bonvoisin-Deprez, owner of 5 shares;

A. Lowet, owner of 5 shares;

Ruys et Cie, owner of 2 shares;

François Greil, owner of 1 share;

Prosper Greitz, owner of 2 shares;

Société Anversoise du Commerce au Congo, owner of 150 shares;

Julien Van Stappen, owner of 10 shares;

L. & W. Vandevelde, owner of 5 shares

First Board of Directors

The Board of Directors at the incorporation of this new Company was represented by MM Van Den Nest Arthur, Chairman; Mols Alexis; Count Van Der Burgh; De Browne de Tiège; Van Stappen (25-135 to 137).

Object

The object of the A.B.I.R. was to carry out, within the widest possible limits, all commercial operations involving imports and exports, armaments, commercial and industrial, mining, forestry, agricultural and other operations.

To this end, the Company could acquire and resell concessions or movable or immovable property useful or necessary for its trade or industry, institute legal proceedings in its name, compromise and take any action it deemed useful or necessary (1).

Investments, operations, results, stock quote, dividends

In 1896, the Company exported 265 tons of rubber, rising to 1,230 tons in 1900. Dividends were paid to the shareholders accordingly: 1 franc in 1893 and 1894, 55 Belgian francs in 1895, 200 Belgian francs in 1896, 500 Belgian francs the following year, then 1,100 Belgian francs in 1898 and up to 2,100 Belgian francs, and this after large amortizations which allowed various balance sheet items to be reduced to zero, in particular furniture in Belgium and plantation equipment in Africa.

With only 232,000 Belgian francs paid into the constitution (1892), the A.B.I.R. had achieved extraordinary results. By 1900, it had therefore managed to achieve more than 20 times its paid-up capital (net profit of 5 million Belgian francs). The shares were then quoted at 19,600 Belgian francs.

Their operating concessions were located in the basin of the Lopori and Maringa rivers (13-49, 25-135 to 137).

In 1903, A.B.I.R. took over the operation of the Isanghi company and acquired a stake in the Dutch company Galang, a company with interests in Malaysia (3-134).

The A.B.I.R. and the L’Anversoise company made huge profits, but their concessions were hellish. The agents of these companies knew only one law: the law of profit. Their conduct, in more than one case, hardly differed from that of the indigenous "sentinels" they employed (14-109).

Merger

On 26 October 1911, the Company A.B.I.R. and the Company L’Anversoise merged to form the Compagnie du Congo Belge; as the assets were of equivalent value, 17,000 shares in Compagnie du Congo Belge were allocated to each transferring Company (12-(26/01/1912)-545)