Société de Participations Belges et Coloniales - SOPABEL - S.A

Constitution

On March 15, 1949, the S.A. Société de Participations belges et coloniales, abbreviated as "Sopabel", was established. The head office was established in Brussels.

The share capital was set at twenty-four million francs and was represented by 60,000 shares with no indication of value. Of the 60,000 shares, 59,993 shares were allocated to the S.A. in liquidation Crédit Anversois for the contributions described below.

The seven remaining shares were subscribed at the price of four hundred francs, by:

Mr. Henri Moxhon, Mr. Robert Collignon, Mr. Louis Eloy, Mr. Joseph Plas, Mr. Max Stevens, Mr. Frans Terlinak, Mr. Pierre Davidts, each one share (33-(05/04/1949)-5450).

Contribution(s)

Crédit Anversois (in liquidation) contributed its assets to Sopabel, including the sums or values that could still be paid or allocated to it later. All these assets are valued at 35,767,424.20 francs.

The liabilities of Crédit Anversois assumed by Sopabel are valued at 4,567,424.05 francs, in addition to a fixed valuation of 7,200,000 francs for unrecorded liabilities that may result from judgments or rulings that may be rendered against Crédit Anversois.

In remuneration of this contribution, 59,993 fully paid-up shares were allocated to Crédit Anversois (in liquidation) (21-(1950 T1)-189).

First Board Directors

The number of directors was set at six members and the number of commissioners at two.

Directors :

Messrs. Henri Moxhon, Robert Collignon, Louis Eloy, Joseph Plas, Max Stevens, Frans Terlinak.

Commissioners :

Messrs. Pierre Davidts, Jules Quevrin (33-(05/04/1949)-5451).

Object

All financial, commercial, industrial, agricultural, and real estate operations, of any nature, which may contribute to the investment and management of funds, both movable and immovable, which belong to it, or which may be entrusted to it.

To be able to buy, sell, rent, and manage all movable and immovable property. To be able to take an interest by way of contribution, transfer, participation, merger, in all syndicates or companies likely to develop its corporate purpose (33-(05/04/1949)-5450).

Change in capital, event(s), dividend(s), quotation

During the first year, the Company's activity consisted of the continuation of the transactions involving the Sopaflnin shares and the Antwerp Credit shares. In June, the Antwerp Commercial Court ruled against the plaintiffs, but they appealed (21-(1950 T1)-189).

Subsequently, Sopabel became a holding company with interests in industrial, agricultural, and real estate enterprises as well as Congolese companies.

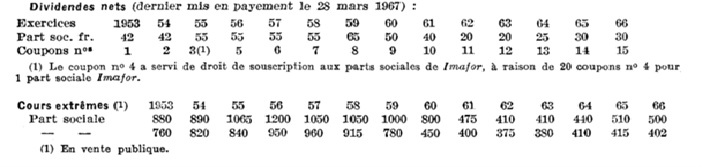

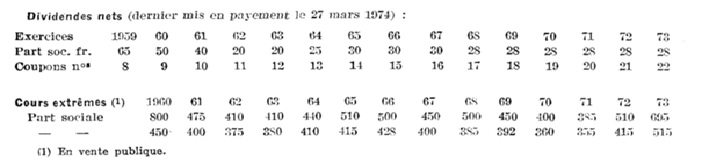

From 1953 onwards, the Company distributed a dividend every year until 1977.

At the end of December 1954, the Company had holdings worth thirty-five million francs, including Texaf "Société Textile Africain", Utexléo "Usines Textiles de Léopoldville", Société des Forges Hydro-Electrique de Sanga (21-(1955 T1)-158/159).

Sopabel's main activity will be the management of its portfolio of participations.

In 1956, the coupon n° 4 detached from the share allowed to subscribe to the capital increase of the company IMAFOR " Société Immobilière, Agricole et Forestière du Congo " at the rate of one IMAFOR share for twenty coupons n°4; issue price: 975 francs (21-(1957 T1)-119/120).

On June 19, 1973, the A.G.E. decided to increase the capital of thirty million francs to bring it to sixty million francs, by the creation of 90.000 new social shares without value designation. These fully paid-up new shares were delivered in remuneration of the contribution of the 37.500 Texaf shares. Between the value of the contributed shares and the amount of the capital increase, i.e., eighteen million francs, this sum was transferred to an unavailable reserve account. In the same year, the company changed its name to SOPABEL "Société de participations Belges".

After this operation, the value of the portfolio as of December 31, 1973, amounted to eighty-eight million francs (21-(1974 T1)-148/149).

In 1978, the loss carried forward was cleared by reducing the capital by 22.5 million francs and by drawing on reserves, the capital was then 37.5 million francs represented by 150,000 shares (2-(1981)- R 35).

Between 1978 and the dissolution of the Company, capital reductions took place to reach 9,450,000 francs at the closing of the liquidation (2-(1983)- R 38)

(21-(1967 T1)-56)

(21-(1974 T1)-148/49)

Dissolution and liquidation

On March 13, 1980, Sopabel was dissolved and put into liquidation; a reimbursement of sixteen francs per share was distributed from December 27, 1979. A second distribution of nine francs was made on December 29, 1981, upon presentation of the counterfoil (2-(1981)- R 35).

On April 6, 1982, the liquidation was closed (2-(1983)- R 38)