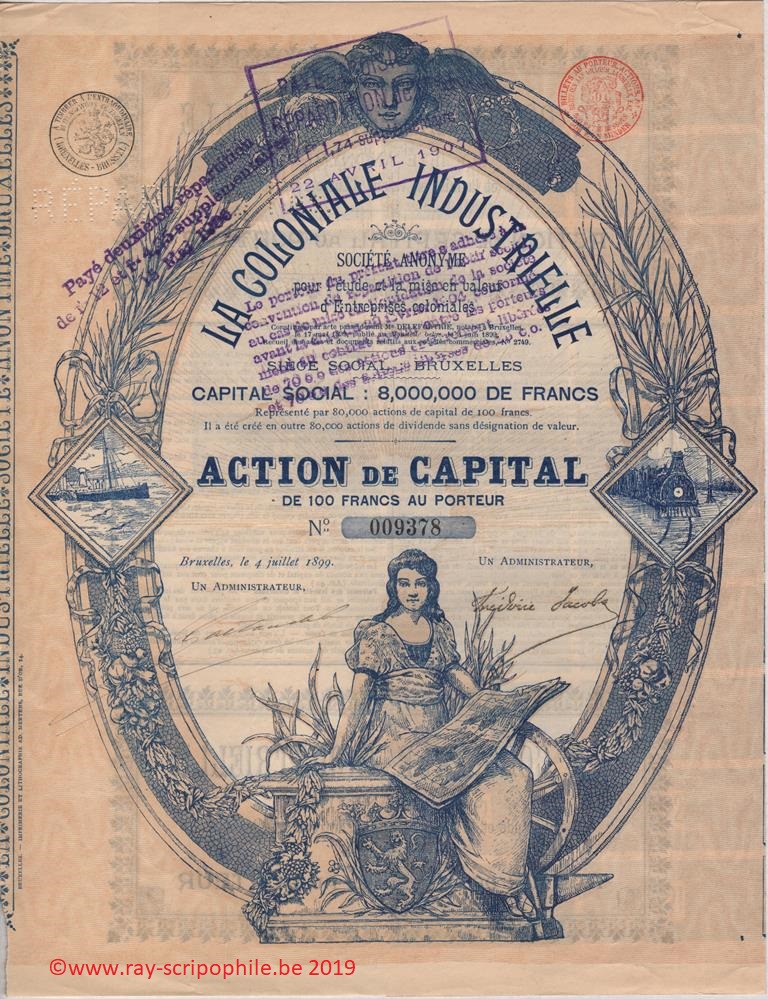

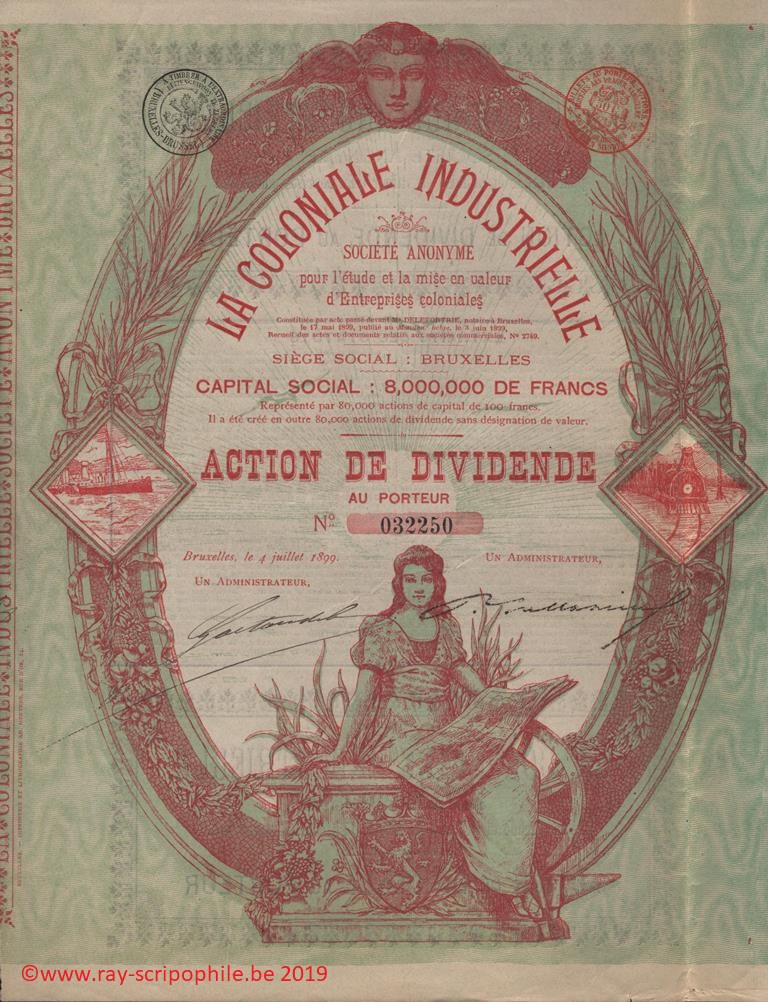

LA COLONIALE INDUSTRIELLE - Société Anonyme pour l'Etude et la Mise en Valeur d'Entreprises Coloniales

Constitution

The La Coloniale Industrielle was formed on May 17, 1899 at the initiative of the S.A. Crédit National Industriel; the head office was established in Brussels.

The capital of 8 million francs was represented by 80,000 shares of capital of 100 francs; in addition, 80,000 dividend shares were created without mention of value.

The 80,000 shares of 100 francs freed up by 25% were subscribed by 460 subscribers and 2 million francs made available to the new company; the dividend shares were handed over to the S.A. Crédit National Industriel for its contribution.

Contributions

As a special benefit and to pay for the studies, works and disbursements that the S.A. Crédit National Industriel made in order to arrive at the constitution and organization of the new company and also to pay for the various competitions to which it had to resort, the S.A. The Crédit National Industriel received 80,000 dividend shares which were distributed among the interested parties based on special agreements.

First Board of Directors

Object

Change in capital, events, participations, dividends

In the 1901 report, it was stated that the portfolio was valued at 2,423,178 francs plus 1,086,271 francs leftto pay. In 1900-1901, the company became interestedin the Floridian Phosphate Company (Florida-USA) and in the Ratkoviça Coal Mines (Croatia).

In 1903, a committee was appointed to study the situation for liquidation. The portfolio included Ratkoviça, Floridian Phosphates and Belgo Canadian Pulp shares valued at 844,500 francs and other securities valued at 250,000 francs. There were still 900,000 francs to be recalled on securities, especially on Ongomo shares. This company concessionaire a territory in the French Congo inactive without being able to put its concession to fruit.

The Company distributed a dividend of 5 francs for the first two years (21-(1904 T1)-634/635).

Dissolution and liquidation

The Company was dissolved on December 29, 1903.

1905 - The portfolio, valued by the estimates of the former administration, consisted mainly of 200,000 belgian annuity francs, 407 priv.de 250 francs Crédit National Industriel (realized since), 2,970 act. 250 francs and 389 obl. Ratkoviça coal,760 priv. 250 francs and 580 ord. Central America (6%6%), the surplus appears to be of little value. The Company committed another 100,000 francs to Ratkoviça (21-(1910 T1) -802).

1906 - To the fully released stamped shares, it was distributed 12 francs as a second allocation (the first was 5 francs) plus 4.35 francs; to the unstamped shares, fully released, he was paid 4.50 francs for interest (21-(1910 T1) -802).

1907 - A third allocation of 5 francs plus an additional 1.74 francs; to the securities released non-membering of the convenio, he was paid 2.25 francs as interest (21-(1910 T1) -802).

1909 - Ratkoviça is completely lost, other titles were sold (21-(1910 T1)-802).

1910 - On May 28, the liquidators were discharged from their mission; then on a personal basis, they took over the corporate assets and undertook to pay off the debts and distribute, for pay, 9.30 francs to the 17,954 fully released shares, members of the convenio, and 3.10 francs to the 256 shares released from 50%% still outstanding, for their benefit of unclaimed allocations and a lot of shares of founder Genval-les-Eaux (21-(1911 T1) -47). ? There were probably buybacks or abandonments of Company shares during the liquidation?