Mutuelle Belgo-Coloniale S.C.R.L.

Constitution

The Mutuelle Belgo-Coloniale was founded on April 17, 1928. The head office was established in Leopoldville, the administrative office in Brussels.

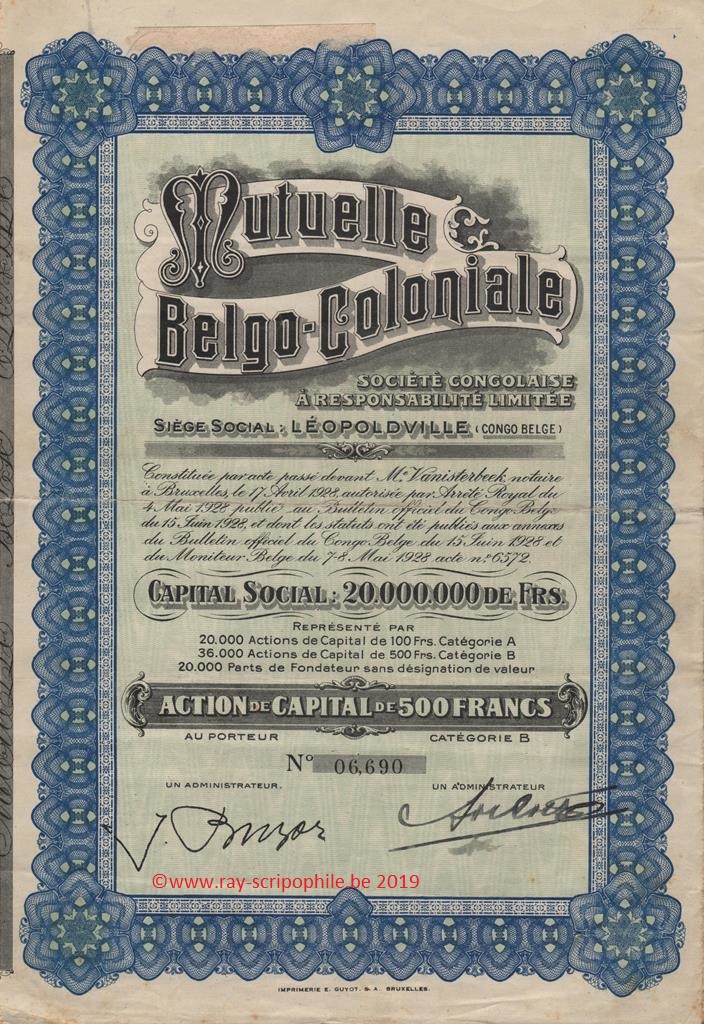

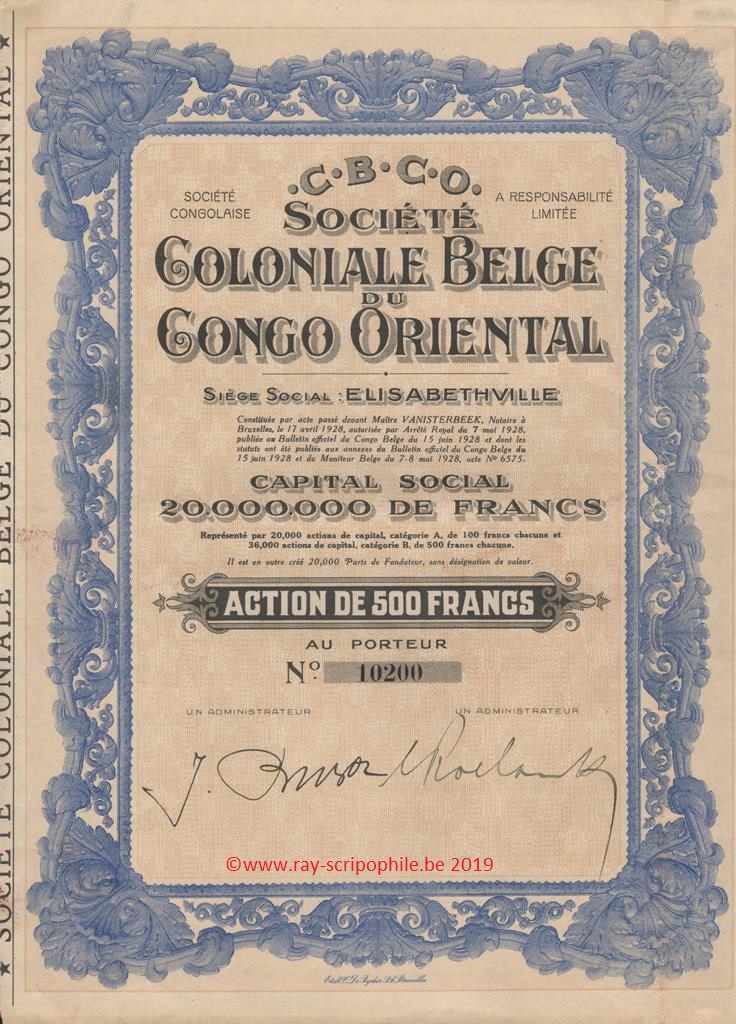

The share capital was 20 million francs, represented by 20,000 shares of 100 francs, class A, and 36,000 shares of 500 francs, class B.

The capital shares were subscribed for cash and 20% paid up, i.e. 20 francs for the 100 francs shares and 100 francs for the 500 francs shares.

The shares were subscribed by 14 comparators:

La Compagnie Coloniale Belge, alias Plantations et Elevages de Kitobola, 14,000 Series A shares and 11,000 Series B shares; Comptoir Belge-Congolais de Matériaux (Belcoma), 4,000 Series A shares and 2,000 Series B shares; M. Jean-Pierre Buzon for himself and for a group, 10,160 Series B shares; Mr. Benoît Gravez for himself and for a group, 2,000 Series B shares; Mr. Louis Roelants for himself and for a group, 3,000 Series B shares; M. Colonel Louis Chaltin, 40 Series B shares; A.E.V. Paligot et Cie Limited Partnership for itself and a group, 4,000 Series B shares; Mr. Jules Levita for himself and a group, 400 Series B shares; Eliot et Loman Limited Partnership for itself and a group, 800 Series B shares; Mr. Raymond De Nucé for him and a group, 1,000 Series B Shares; Mr. Henri Kullmann for him and a group, 200 Series B Shares; Mr. Charles Marc, 320 Series B Shares.

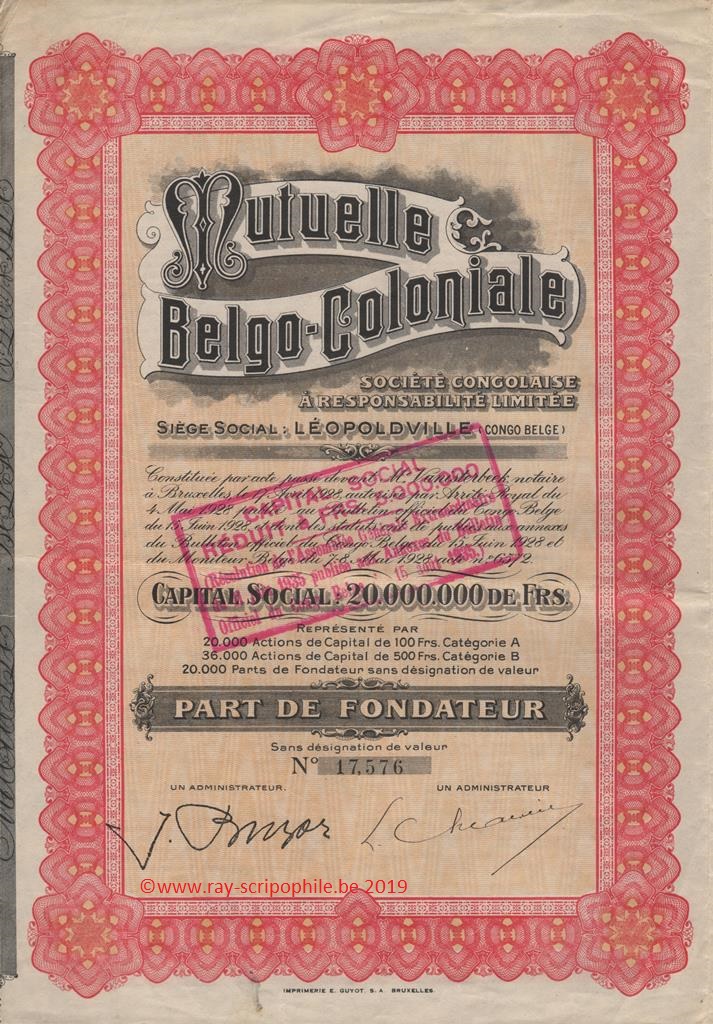

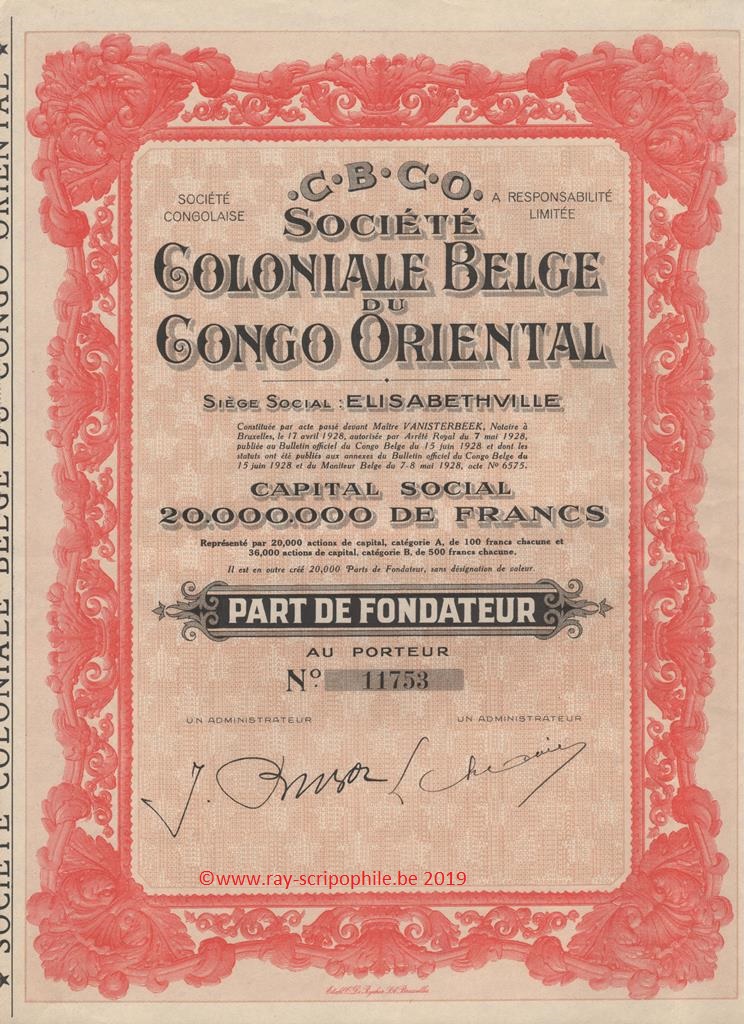

In addition, 20,000 Founder Shares without designation of value had been created; these shares could be divided into denominations.

Contribution(s)

Mr. Jean-Pierre Buzon contributed to the Company currently incorporated the benefit of his personal work, steps, and studies with a view to the incorporation of the Mutuelle Belgo-Coloniale.

In remuneration of this contribution, Mr. Jean-Pierre Buzon was allocated the 20,000 founder's shares of the Company, at the expense of Mr. Buzon to remunerate the contributions he had been able to make and to distribute all or part of the said founder's shares among the original subscribers of capital shares in accordance with their specific agreements.

First Board of Directors

The number of directors for the 1st Board was set at seven members: Messrs. Benoît Gravez, Jean-Pierre Buzon, Louis Chaltin, Raymond De Nucé, Alfred Paligot, Marcel Loumaye, André De Cock

Object

The purpose of this Company of the Buzon Group was to provide financial services to the companies of the Compagnie Coloniale Belge Group, including: Compagnie Coloniale Belge, Comptoir Belgo-Congolais de Matériaux (Belcoma), Compagnie Belgo-Coloniale de Constructions Métalliques, Coloniale Belge du Congo Oriental C.B.C.O. and any other companies that may be subsequently created or absorbed or in which the Mutuelle Belgo-Coloniale would be interested, to handle all banking and financial, commercial, industrial, agricultural, forestry, maritime, mining, real estate and other operations, both in the Belgian Congo and in Belgium and in all other countries (12-(7-8/05/1928)-6572).

Event(s), shareholding(s), dividend(s), stock quote, etc.

In 1935, the capital was reduced to 5 million francs, the nominal value of the 40,000 unified shares was then reduced to 125 francs (12-(04/08/1935)-11713).

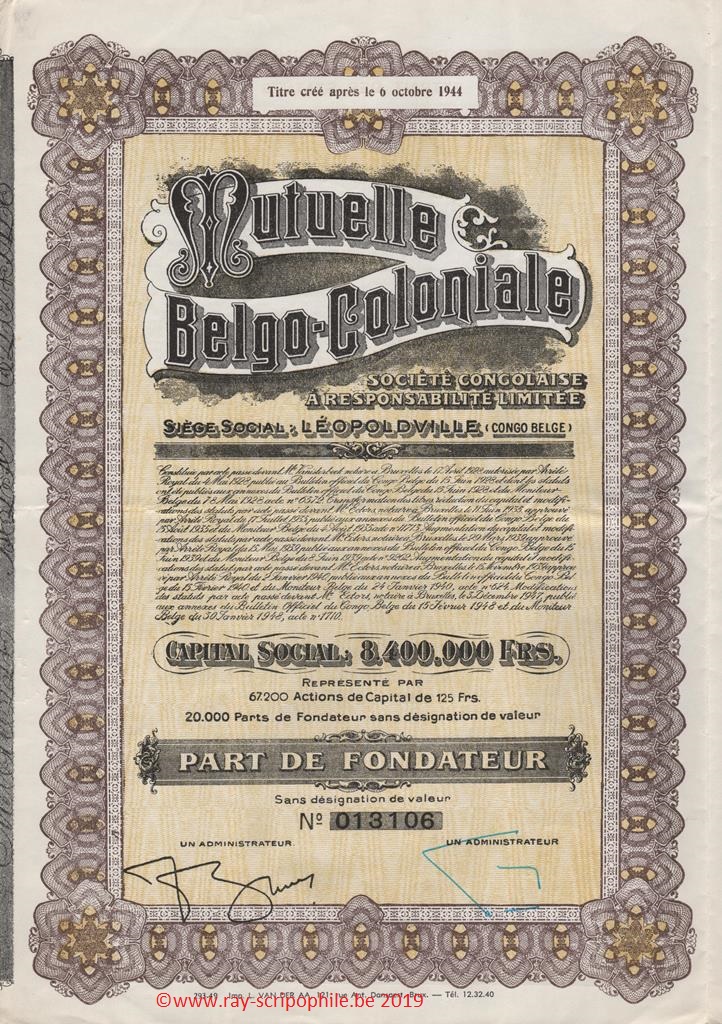

In 1939, the Company absorbed, by way of merger, the Congolese companies Comptoir Belgo-Congolais de Matériaux Belcoma and C.B.C. O Société Coloniale Belge du Congo Oriental; to absorb these two companies, the Mutuelle Belgo-Coloniale increased its capital by 3.4 million francs to 8.4 million francs, this capital was then represented by 67,200 shares of 125 francs((12-(08/06/1939)-9262) (24/01/1940)-624)).

Since the existence of the Company, profits were carried forward and no dividends were distributed, but it was only after the Second World War that the situation changed. A first dividend for the 1946/47 financial year of 6.142 francs was distributed to the capital shares (2-1948). Thereafter, a dividend was distributed every year until 1959 (2-1949 to 60).

The Mutuelle Belgo-Coloniale was listed on the Brussels stock exchange; in 1938/39, the capital share and the founders' share were listed at a maximum of 30 francs and 21 francs respectively (2-1948).

Hereafter, renewal of the founder's share:

On January 10, 1952, the capital was increased to FRF 10.580 million by the creation of new shares. The capital was then represented by 84,640 shares of FRF 125 (2-1952).

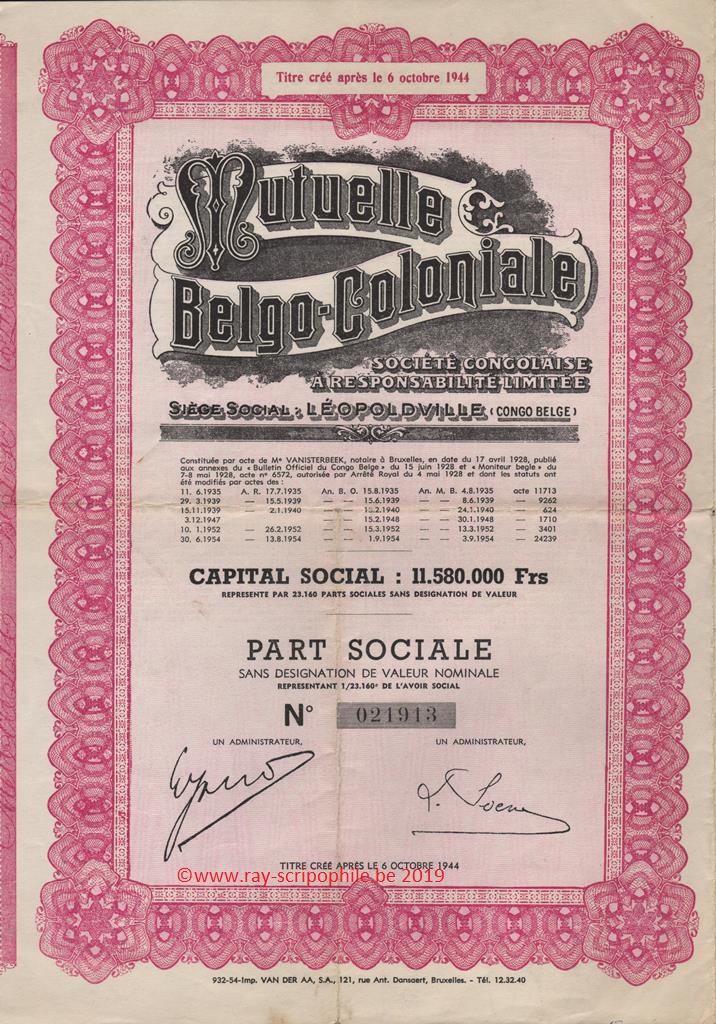

On June 30, 1954, the capital was increased by 1 million francs from the legal reserve of 400,000 francs and 600,000 francs from retained earnings. On the same day, it was decided to change the representation of the capital, the shares were exchanged at the rate of 1 new share for 4 old shares or 10 founder's shares. The capital of 11,580,000 francs was then represented by 23,160 shares.

On 9 September 1955, a new issue of shares at a price of 525 francs brought the capital to 23.5 million francs, this capital was then represented by 47,000 shares (2-1955).

In the course of 1960, the Mutuelle Belgo-Coloniale changed its legal status to that of a company under Belgian law and took the name Financière Congolaise, with its registered office in Brussels (Law of 17 June 1960).

At the end of 1960, the book value of the portfolio was estimated at +/- 25.800 million francs (2-1961).

The Mutuelle Belgo-Coloniale, which became Financière Congolaise, was a small holding company that controlled three companies:

La Compagnie Coloniale Belge alias Plantations et Elevages de Kitobola P.E.K. (which in 1960 became the Compagnie Commerciale PEK) which owned plantations, livestock farms and a commercial sector.

L'Immobilière Belge-Coloniale (now Immobilière Van Gèle), which dealt with the renting of buildings.

La Société des Boissons et Eaux Minérales du Congo Minéral-Congo (4-261)

For the next twelve years, following losses and forecasts for portfolio fluctuations (+/-18.5 million at the end of 1971) (2-1972), the Company did not distribute any dividends; it was only from 1972 onwards that the situation improved, making it possible to distribute a dividend that would remain constant until its change of name (2-1976).

The price of the share rose sharply: max 1971, 236 francs; max 1976, 460 francs (2-1976).

In 1976, it changed its corporate name to Financière Internationale de Participations and its corporate purpose was the placement and arbitrage, on a temporary or permanent basis, in all Belgian and foreign movable and immovable securities; the securities were exchanged on the basis of one new share Financière de Participation Internationale coupon 1 attached for one share Financière Congolaise (formerly Mutuelle Belgo-Coloniale) coupon 12 attached (2-1977).