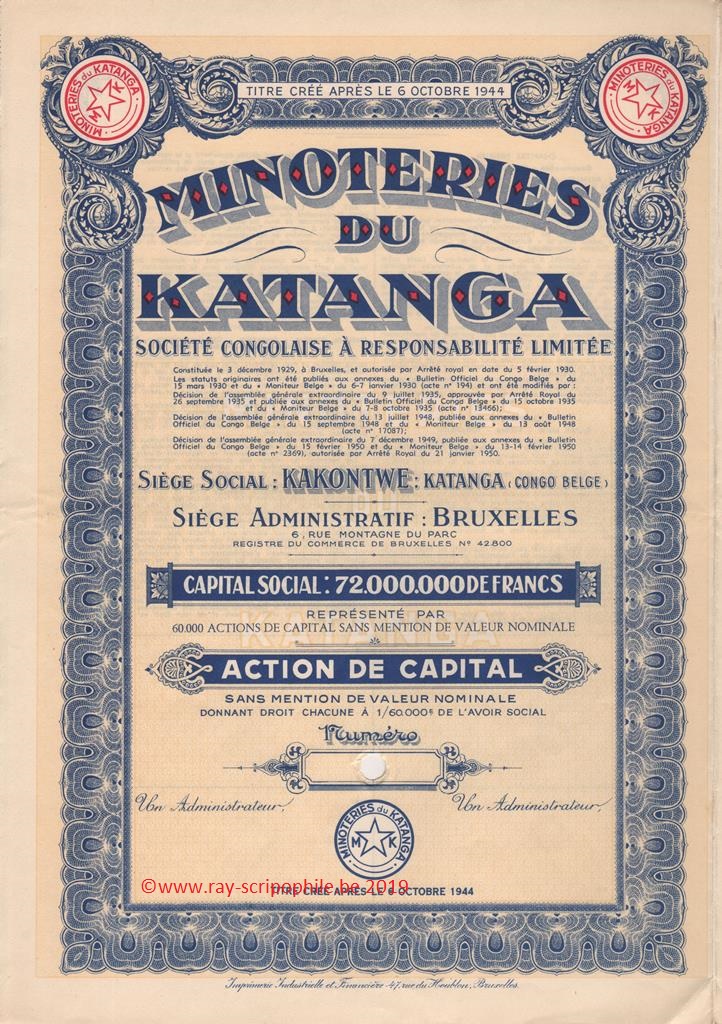

MINOTERIES DU KATANGA S.C.R.L.

Constitution

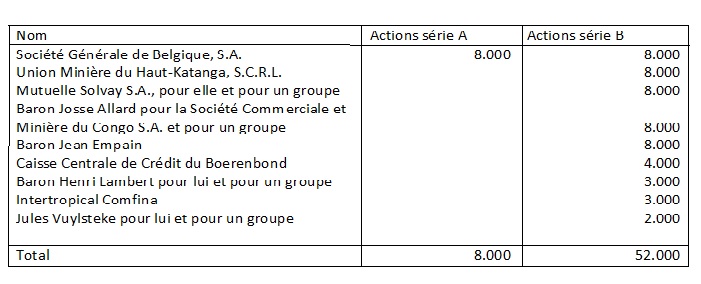

At the initiative of Union Minière du Haut-Katanga, Société Minoteries du Katanga was incorporated on December 3, 1929, with a capital of 30 million francs represented by 8,000 Series A shares and 52,000 Series B shares, all with a nominal value of 500 francs. The registered office was established in Kakontwé (Katanga) and the administrative headquarters in Brussels.

The capital was subscribed by:

The shares were 90% paid up, making a total of 27 million francs available to the Company.

Board of Director in 1930

Messrs. Firmin Van Brée, Jules Vuylstele, Jules Cousin, Joseph De Mulder, Arthur Bolle, Baron Jean Empain, Odon Jadot, Baron Henri Lambert, Gilbert Mullie, John Nieuwenhuys, Colonel Albert Paulis, Edgard Sengier (21-(1931-T3)-487).

Object

The milling and any other industrial processing of cereals and any vegetable substances, their by-products and derivatives, and trade in these various commodities. To carry out all agricultural, commercial, industrial, and financial operations necessary or useful for the realization of this object. To take an interest, in particular through contributions, mergers, subscriptions and participation in financial intervention or otherwise, in any company whose object would have been analogous or related or whose contribution would have been likely to develop or facilitate its activity (12-(06-07/01/1930)-194).

Change(s) in capital, event(s), shareholding(s), dividend(s), listing, etc.

As soon as it was formed, the Company took over from the syndicate that preceded its creation, facilities already in operation, as well as the contracts ensuring the activity of its plants. Its Facilities included a corn mill, with a capacity of 60 tonnes per day, with cleaning, degerming and oil extraction facilities, as well as storage silos with a capacity of approximately 4,000 tonnes. A cassava mill was added in the year. The whole was erected on a 16-hectare site in Kakontwe near Likasi, connected to the railway and served by an electrical power supply. In addition, at the beginning of January 1931, the Company bought the corn and wheat mills that the Société Commerciale et Minière de l'Uélé operated in Elisabethville from the Société Commerciale et Minière de l'Uélé. During the year, the Company processed approximately 7,000 tonnes of corn and 1,300 tonnes of cassava carrots. The flours produced by its mills, 80% of which was maize and 90% of which was manioc, were of the highest quality and perfectly preserved. As for the by-products of the milling process, the bran and oilcake were easily sold to the livestock companies, while the oil was used by industrial customers. The results of the first year, although influenced by the crisis that temporarily hindered the development of Katanga, were encouraging and augured well for the future (21-(1932 T3)-461/62).

This Society played an important role in maintaining the health of indigenous workers and their families, manufactured vitamin flours and iodized salt and contributed to the development of maize, wheat, and castor crops in Belgian Congo (06/226).

In 1935, the Company decided to reduce the capital by 6 million francs to 24 million francs, by exempting all A and B shares from the 10% (50 francs) payment still to be made, the nominal value of each share was reduced to 400 francs (12-(07-08/10/1935)-13466).

During the Great Depression, the Minoteries du Katanga saw their production of maize, manioc, and wheat flour fall from more than 8,000 tonnes in 1931 to 5,000 tonnes in 1932 and 1933 (06/172). This production was 14,000 tonnes in 1939, 22,000 tonnes in 1946 and 32,000 tonnes in 1955 (06/179 and 226). At independence, production reached 36,000 tonnes.

On December 7, 1949, the Company converted the 8,000 Series A shares and the 52,000 Series B shares into 60,000 capital shares wdvwithout designation of value and increased the capital by BEF 48 million to BEF 72 million by incorporating into the share capital the revaluation surplus of fixed assets of BEF 47,067,477 and by incorporating a sum of BEF 932,523 from the forecast fund 12(13-14/02/1950)-2369).

The Society had two operating headquarters; Kakontwé and Elisabethville, a third in Kolwezi was opened in 1953 (06/226).

In 1954, on June 23rd, the assembly noted that the francs expressing the share capital are Congolese francs, it proceeded to the cancellation of the 5.000 shares of capital repurchased by the company in the Thirties with the funds of forecast.

This same meeting proceeded to an increase in capital of 13.7 million Congolese francs to bring it to 85.7 million Congolese francs by incorporation of a sum of 13.7 million Congolese francs taken from the forecast fund. To represent this increase, the meeting created 11,000 shares of capital, these were given free of charge to the holders of old shares at the rate of one new share for five old shares.

On the same day, a new increase of 14.3 million Congolese francs was decided upon; to this end, the Company created 11,000 new shares which were offered to the shareholders of the 55,000 old shares for subscription in cash at a price of 1,300 Congolese francs plus 55 Congolese francs for expenses, in the irreducible proportion of one new share for five old shares (12-(23-06-1954)-17760).the capital will then be 100 million Congolese francs represented by 77,000 shares of capital wdvwithout designation of value.

In 1958, the Company participated in the Brussels International Exhibition in the agricultural industries section of the Belgian Congo (21-(1960 T2)-1560/61).

Following the decision of the Board of Directors on June 28, 1960, in accordance with the law of June 17, 1960, the Board decided to maintain the Company under Belgian law and to express the capital in Belgian francs. The corporate purpose will be modified (12-(17-01-1964)-1255).

On February 13, 1962, it transferred its activities in Africa to a new S.C.A.R.L. Société Africaine des Minoteries du Katanga MINOTKAT (02-(1965)-488). Since then, the Company continued its assistance to its subsidiary until the Zaireanization by the Zairian State (21-(1975 T4)-2509/10).

Subsequently, in 1972, the company changed its name to Société Auxiliaire de Minoteries (12-(08-04-1972)-747). In 1980, the Company reoriented and allied itself with a third-party group which was involved in the management of laboratories, hence the new name "Biocare" (Echo of 27/05/1993).

Regarding dividends, this company distributed a dividend every year; from its first financial year, it distributed 22.50 francs per share, which rose to a crescendo until the 1960 financial year.

The share was listed at public sales on the Brussels stock exchange, the first information about the share price dates from the financial year 1937, the price was 450 francs, after the war 40-45 the price fluctuated between 1,750 and 3,950 francs respectively for the financial years 1947 and 1954. After the events of 1960, the share price fell to around 400 francs (02-(1950-1957-1965)-xxx).

Merger, bankruptcy, dissolution, and liquidation

In 1995, Biocare changed its name to Brederode Insurance, which was dissolved and put into liquidation on March 21, 2001; it closed on April 23, 2001 (12-(26-05-2001)-516).